Nearly two years have passed since the Securities and Exchange Commission (SEC) proposed climate-related disclosure rules for large, publicly traded companies. And with the release of the finalized rules on March 6th, speculation around corporate reporting requirements is replaced with certainty.

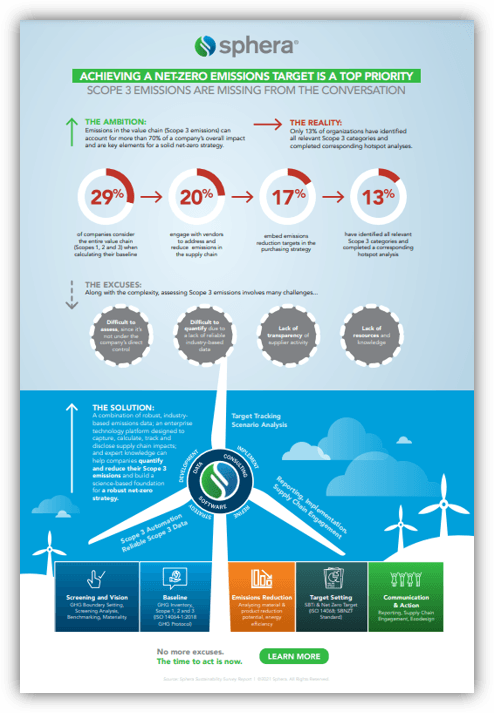

In the end, the SEC decided to remove Scope 3 disclosures from the rules. But many of the companies that will fall under the SEC rules may find they need to report their value chain emissions under other regulations.

Under the finalized SEC rules, disclosures of Scope 1 and Scope 2 emissions (if deemed material) are required from large accelerated filers and accelerated filers. An assurance report at the limited assurance level is required; after a transition period, large accelerated filers will need to provide reports at the reasonable assurance level.

For decades, the SEC has worked to facilitate investor access to information on the environmental risks faced by public companies, but investor needs are now more critical. Investors urgently need climate risk disclosures to assess the impact of these risks on their current and potential investments.

Overall, today’s ruling is a big step for the U.S. in terms of scale and importance. Scope 1 and Scope 2 emissions disclosure rules have the potential to set the bar for future requirements and make a real difference to the health of our planet.

Climate-related disclosure rules in other jurisdictions

The need for these disclosures has already been addressed in other parts of the world and in the state of California, where companies will soon be required to report on GHG emissions. As a result, many businesses that must comply with the SEC’s rules have already built—or are building—reporting practices in preparation for other climate-reporting regulations.

“Even with the removal of Scope 3, thousands of U.S. companies will have to comply with Scope 3 reporting requirements under the EU’s Corporate Sustainability Reporting Directive, California’s Climate Corporate Data Accountability Act or both. This will also impact supply chain partners of companies that need to report, whether or not the suppliers fall within the scope of these reporting regulations,” said Sphera CEO Paul Marushka.

California’s Climate Corporate Data Accountability Act (SB 253) obligates public and private companies with over $1 billion in revenue to disclose their greenhouse gas (GHG) emissions, including Scope 3 emissions. Under the state’s Greenhouse Gases: Climate-Related Financial Risk Act (SB 261), public and private companies with annual revenue exceeding $500 million must disclose the climate-related financial risks they face, as well as the measures they are taking to reduce these risks and adapt to them.

The EU’s Corporate Sustainability Reporting Directive (CSRD), which went into effect on January 5, 2023, requires roughly 50,000 companies to provide sustainability information in line with the European Sustainability Reporting Standards. The directive also applies to non-EU companies with an annual net turnover of at least €150M in the EU and at least one subsidiary or branch in the EU. Of the 10,000+ non-EU companies that must comply, roughly one-third of them are U.S. companies. Scope 3 GHG disclosures are required under the CSRD.

Additionally, the U.K. published mandatory climate-related financial disclosure rules in early 2022. And India’s top 1,000 listed companies must now disclose their emissions and other ESG-related impacts through the Business Responsibility and Sustainability Report issued by the Securities and Exchange Board of India in 2021.

Who must comply with the SEC regulations? And when?

The SEC’s climate-related disclosure regulations for companies apply to large, publicly traded businesses that fall into the following categories:

- Large Accelerated Filer – a company that has a public float “of $700 million or more, as of the last business day of (its) most recently completed second fiscal quarter.”

- Accelerated Filer – a company that has “a public float of $75 million or more, but less than $700 million, as of the last business day of (its) most recently completed second fiscal quarter.”

Large accelerated filers will first have to report their Scope 1 and Scope 2 emissions for fiscal year 2026; accelerated filers will need to report these emissions beginning with fiscal year 2028.

Have companies developed the reporting capabilities they will need for the SEC’s regulation?

Overall, we are still in the early stages of emissions disclosure regulations, and we anticipate more rulings and requirements to follow from regulators on a global scale. Most large multinational companies have taken or are now taking the necessary steps to develop reporting capabilities in order to remain in compliance with these changing requirements.

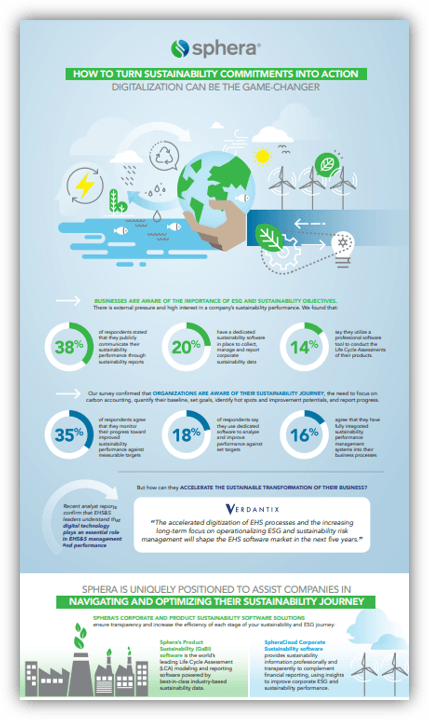

However, without the right tools and partners to advise leadership on the changing landscape, companies may face roadblocks in setting up the right processes to track and report their impacts. Sphera works with our clients to put in place corporate systems for recording emissions and operations data that are centralized, so they not only meet reporting requirements but also gain better insights into their operations for enhanced decision-making.

How Sphera can help

Sphera’s offering includes award-winning software solutions and data that enable companies to fulfill their reporting obligations in multiple jurisdictions. And with decades of expertise and industry knowledge, Sphera’s sustainability experts are skilled at guiding businesses through the maze of disclosure requirements and voluntary reporting frameworks. Located throughout the U.S., U.K., EU and Asia, they understand the complexities of corporate sustainability reporting, particularly as they concern companies with a global presence.

Sphera’s solutions include:

- The SpheraCloud Corporate Sustainability solution helps companies gather the data they need to meet the various components of ESG and sustainability reporting:

– Management and Reporting

– Environmental Impact Calculation

– Performance Management and Improvement

– Portfolio Management for Financed Emissions

- SpheraCloud Environmental Accounting software enables companies to measure, monitor and report their air/GHG emissions and management of water and waste. This software was recognized by Environment + Energy Leader as a 2023 Product of the Year.

- Sphera’s market-leading LCA automation solution allows companies to quantify the environmental impact of entire product portfolios in a fraction of the time it takes to conduct life cycle assessments (LCAs) product by product. It provides the most accurate, cost-effective way to generate the information needed to meet Scope 3 reporting requirements.

- Sphera’s Supply Chain Sustainability offering enables buyers and suppliers to connect and share information, facilitating the seamless collection of data for Scope 3 emissions reporting. It provides overall supply chain transparency for improved supply chain management.

Conclusion

We applaud the SEC for using its authority to take the next step in standardizing and clarifying emissions requirements in the U.S. and for delivering a ruling that incorporated stakeholder feedback along the way. Public companies in the U.S. now know what’s required under the SEC’s climate-related disclosure rules. The sooner they start preparing, the more smoothly their reporting activities will go.