As the number of corporations worldwide has exploded over the last several decades—to about 333 million as of 2021—so have the demands on companies to do more than just sell products and make money. Consumers, investors and employees expect businesses to evaluate their impact on society and, if needed, make changes that ensure that impact is positive. To do this, companies may consult two related but distinct frameworks: corporate social responsibility (CSR) and environmental, social and governance (ESG). What is the difference, and what is each concept best suited for? We break it down in this article.

What Is CSR?

CSR encompasses the actions a business takes to advance social and environmental causes and is often traced back to American economist Howard Bowen, who published “Social Responsibilities of the Businessman” in 1953. However, the idea didn’t gain traction until the 1970s, after the Committee for Economic Development (CED) published a statement titled “Social Responsibilities of Business Corporations” in 1971. The thinking that drives CSR is captured most clearly in this CED declaration: “Business functions by public consent, and its basic purpose is to serve constructively the needs of society—to the satisfaction of society.”

There are many ways that corporations might try to improve CSR. A framework referred to as the “Triple Bottom Line,” which covers “profit, people and planet,” is a common approach. The idea behind the framework is that corporations should balance their focus among these categories so they can maintain a profitable business while enhancing society in intentional ways.

CSR goals are sometimes bucketed into the categories of environmental sustainability, ethical practices, philanthropic contributions and economic development. According to the United Nations Industrial Development Organization, common CSR components can include environmental management, stakeholder engagement, responsible and ethical sourcing, fair labor standards and working conditions, human rights and anti-corruption measures, among others.

What Is ESG?

Compared to CSR, ESG is lesser known among members of the general public. Though ESG investing was practiced as early as the mid-1900s, the term didn’t gain wider attention until 2005, when the United Nations Global Compact released the “Who Cares Wins” report in conjunction with 18 financial institutions. The report explained how companies and stakeholders in the financial market could incorporate ESG factors to enhance shareholder value and contribute to “the sustainable development of the societies in which they operate.”

Here’s a high-level breakdown of ESG components:

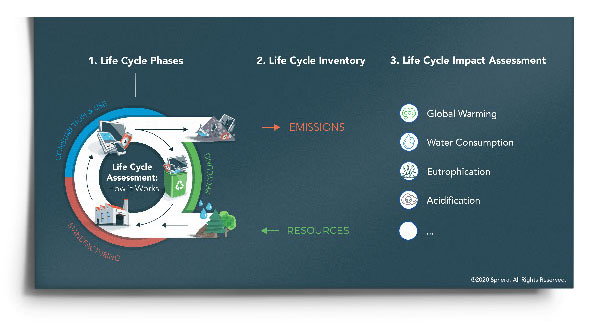

- Environmental considerations include how businesses use energy and manage their environmental impact.

- Social factors involve how companies treat their employees, including how they approach inclusivity and diversity.

- Governance encompasses both compliance with external regulations and the internal system of controls, practices and procedures that companies use to govern and make decisions.

ESG Reporting and Regulations

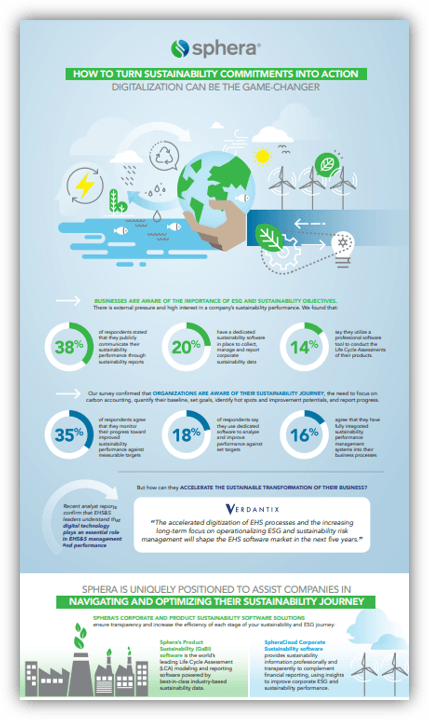

The ESG framework is based on the notion that environmental, social and governance factors have financial relevance, and ESG reporting has become a key tool that investors use to evaluate companies and manage risk. It also provides stakeholders such as partners and consumers with more transparent assessments of how companies perform. The value of ESG reporting—and the need for it—mean that ESG reporting is quickly becoming mandatory for companies globally.

For example, the U.S. Securities and Exchange Commission (SEC) proposed climate-related disclosure requirements for public companies that may go into force as early as 2024. In Europe, the Corporate Sustainability Reporting Directive (CSRD) entered into force in January 2023. India’s Business Responsibility and Sustainability Report (BRSR) is now required from India’s top listed companies. And Singapore has proposed a climate reporting requirement for public and private companies.

ESG reporting is a complex and intensive process. However, a dedicated, continuous focus on ESG metrics pays off. Companies with strong ESG performance have demonstrated higher returns on their investments, lower risks and better resiliency during crises.

How Do CSR and ESG Differ?

While CSR and ESG can both be used to improve a company’s environmental and social impact, these strategies are approached and executed in different ways. Corporate social responsibility is primarily an internal, voluntary system that companies use to enhance their culture. CSR is also largely qualitative in nature, and the specific goals and methods of progress measurement vary significantly from business to business.

The ESG framework was devised with investors in mind, and it has been adopted by many regulatory bodies worldwide. Consequently, ESG uses external reporting standards to help investors identify risks and determine company valuations. One way to think about the relationship between these two concepts is that ESG reporting is a tool to help prove that a company is committed to corporate social responsibility in specific, measurable ways.

[table]

What Is Materiality in ESG?

As part of the ESG framework, companies are typically required to share information on issues that are “material” for their performance. The Sustainability Accounting Standards Board describes materiality as follows:

“Information is financially material if omitting, misstating or obscuring it could reasonably be expected to influence investment or lending decisions that users make on the basis of their assessments of short-, medium- and long-term financial performance and enterprise value.”

Material issues and topics vary from company to company, and they are usually determined by conducting a materiality assessment with input from a company’s stakeholders. Some reporting directives—for example, the CSRD—require double materiality assessments, which means that a reporting business must disclose its impact on the climate and the environment, as well as the impact that climate change has on its operations, finances and outlook.

CSR vs. ESG: Key Takeaways

The CSR and ESG frameworks were developed with different purposes in mind. The application of the CSR framework produces actions and activities that demonstrate a company’s concern for the world around it. The use of the ESG framework, on the other hand, generates quantitative information that indicates how a company’s performance and management of risk stack up against stakeholder expectations. And while these metrics reflect how a company manages its operations with respect to environmental, social and governance components, better risk management and improved performance are the obvious next steps after ESG reporting. In that sense, both the CSR and ESG frameworks promote more responsible business conduct.