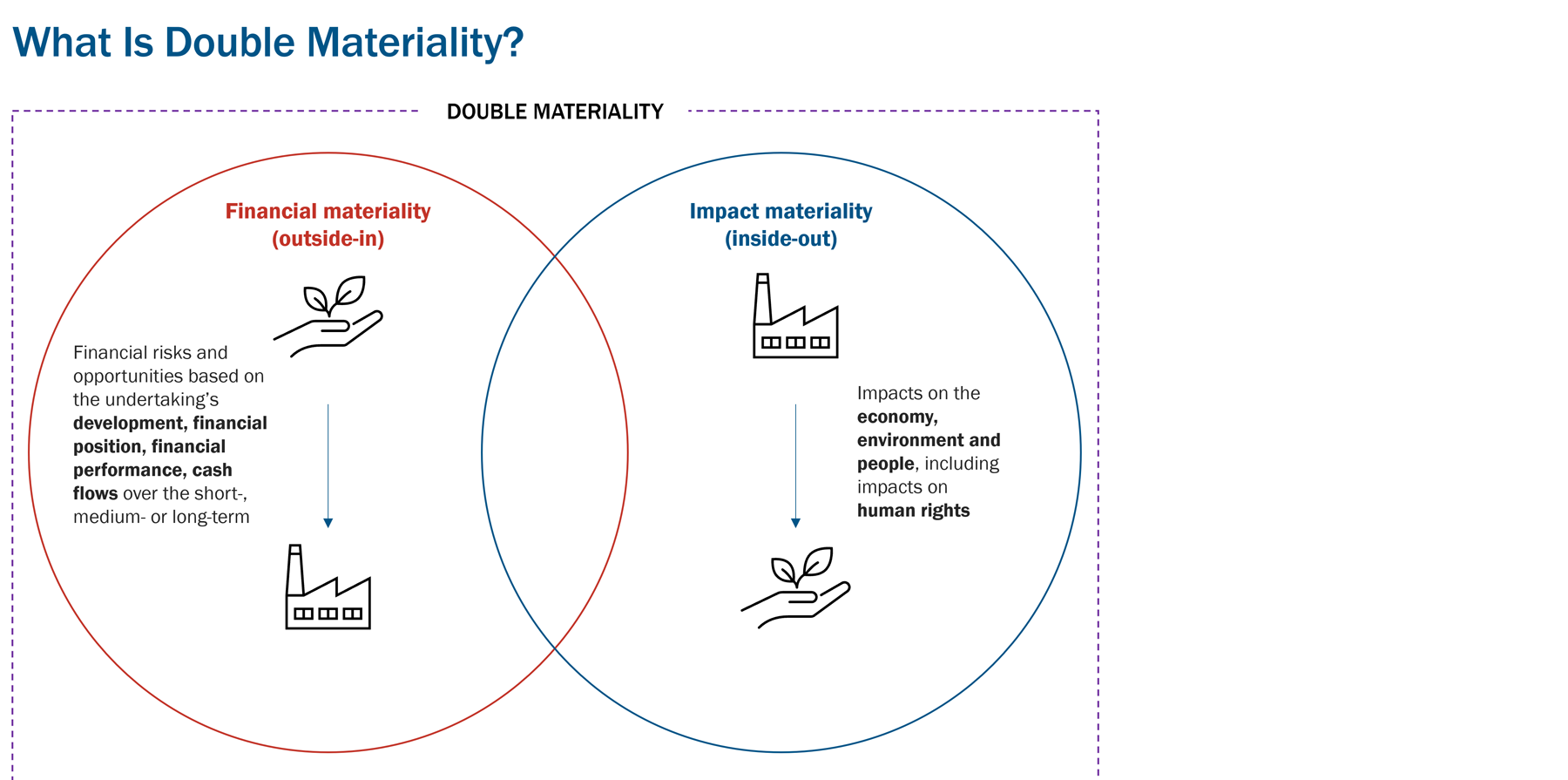

The concept of double materiality has gained significant attention recently due to its inclusion in the European Sustainability Reporting Standards (ESRS). Double materiality encompasses two dimensions: impact materiality and financial materiality. Specifically, double materiality means conducting impact assessments and financial assessments to create a balance between internal and external demands.

This dual perspective contributes to better decision-making and helps companies better align their sustainability targets and business goals. With a more comprehensive view of their material topics, companies can build a robust and transparent sustainability roadmap.

Meeting EU Sustainability Reporting Requirements

The most visible aspect of double materiality relates to its key role within the ESRS and the Corporate Sustainability Reporting Directive (CSRD). This regulatory reporting framework sets the mandatory reporting obligations for large organizations operating in the European Union.

Listed companies on regulated markets in the EU, as well as listed small and medium-sized enterprises (SMEs) fall within in the scope of the CSRD. Moreover, this regulation also impacts non-European companies with substantial activity in the EU market. In this sense, applying double materiality will be crucial for firms covered by the CSRD. Companies that want to follow a best-in-class reporting approach on environmental, social and governance (ESG) matters will also benefit.

Considering Impact Perspectives and Financial Perspectives

According to ESRS 1, double materiality “has two dimensions: impact materiality and financial materiality. A sustainability matter meets the criteria of double materiality if it is material from the impact perspective or the financial perspective or both.”

For many years, the approaches of impact and financial materiality were conducted separately and even considered contradictory. Nevertheless, they are complementary, fostering a strategic and forward-looking approach and promoting more tangible measures to mitigate negative impacts and generate positive ones.

Considering financial and impact materiality together produces a powerful outcome. The double materiality exercise encourages firms to comprehend the interdependence and significance of the company’s impacts on the environment, people and the economy as a result of its activities or business relationships. At the same time, companies get the complete picture by evaluating any direct financial repercussions of sustainability issues on its operations.

Source: Sphera

What Is Impact Materiality?

Impact materiality focuses on identifying, assessing and prioritizing the impacts an organization has or could have on the economy, environment and people as a result of its activities or business relationships. In other words, it follows an “inside-out” approach, concentrating on the positive and negative, actual and potential effects that a firm has on others.

Such effects comprise a crucial element of impact materiality and the understanding of the organization’s context, or business environment and structure. The “inside out” approach also helps stakeholders identify, assess and better prioritize the organization’s impacts.

The Global Reporting Initiative (GRI), which provides some of the most widely used standards for sustainability reporting, was instrumental in developing impact materiality. A double materiality assessment will help companies that use GRI standards transition to ESRS requirements.

What Is Financial Materiality?

Financial materiality focuses on identifying and assessing the sustainability issues that generate (or may generate) risks and opportunities which could financially affect the organization. Examples include the company’s financial position, financial performance, cash flows and access to finance or the cost of capital. This materiality approach is also known as “outside-in.”

Similar to impact materiality, understanding the organization’s context and stakeholder engagement is critical to accurately assessing the firm’s dependencies on natural and social resources. These dependencies could be sources of risks and opportunities, such as the firm’s ability to source materials needed in its business processes. Also, dependencies might influence the company’s reputation, business relationships and investment decisions.

In response to demand for transparent financial-related sustainability disclosures, the International Financial Reporting Standards (IFRS) Foundation created the International Sustainability Standards Board (ISSB). The ISSB is building on existing industry-based initiatives including the Sustainability Accounting Standards Board (SASB) Standards for corporate disclosures.

ISSB-SASB Standards, now part of the IFRS Foundation, are industry-specific standards that identify the most relevant climate change and sustainability issues in each of 77 industries. Based on the standards, companies are able to identify the effect of sustainability matters on their financial performance. The SASB Standards will inform the industry-based requirements in the IFRS Sustainability Disclosure Standards.

Performing a Comprehensive Analysis of Material Topics

The relationship between impact materiality and financial materiality is perhaps best illustrated with an example. The company E-Car Inc. manufactures electric cars and sources batteries from the supplier Charge plc. The batteries contain cobalt and lithium, and child labor was involved during the extraction of these materials by the mining company White Gold Inc.

Although company E-Car Inc. did not directly cause the human rights violation, it is responsible through its business relationship to White Gold Inc. Critically, it is not the proximity or importance of the business relationship that determines the impact, but rather how significant the effect of the violation is.

Seen through the lens of impact materiality, White Gold Inc. created a negative impact on human rights. However, from a financial perspective, E-Car Inc. clearly depends on natural and social resources. This dependence leads to risks such as the high substitution costs of changing to a new supplier or t0 reputational damage, which could lead to decreased revenue flows.

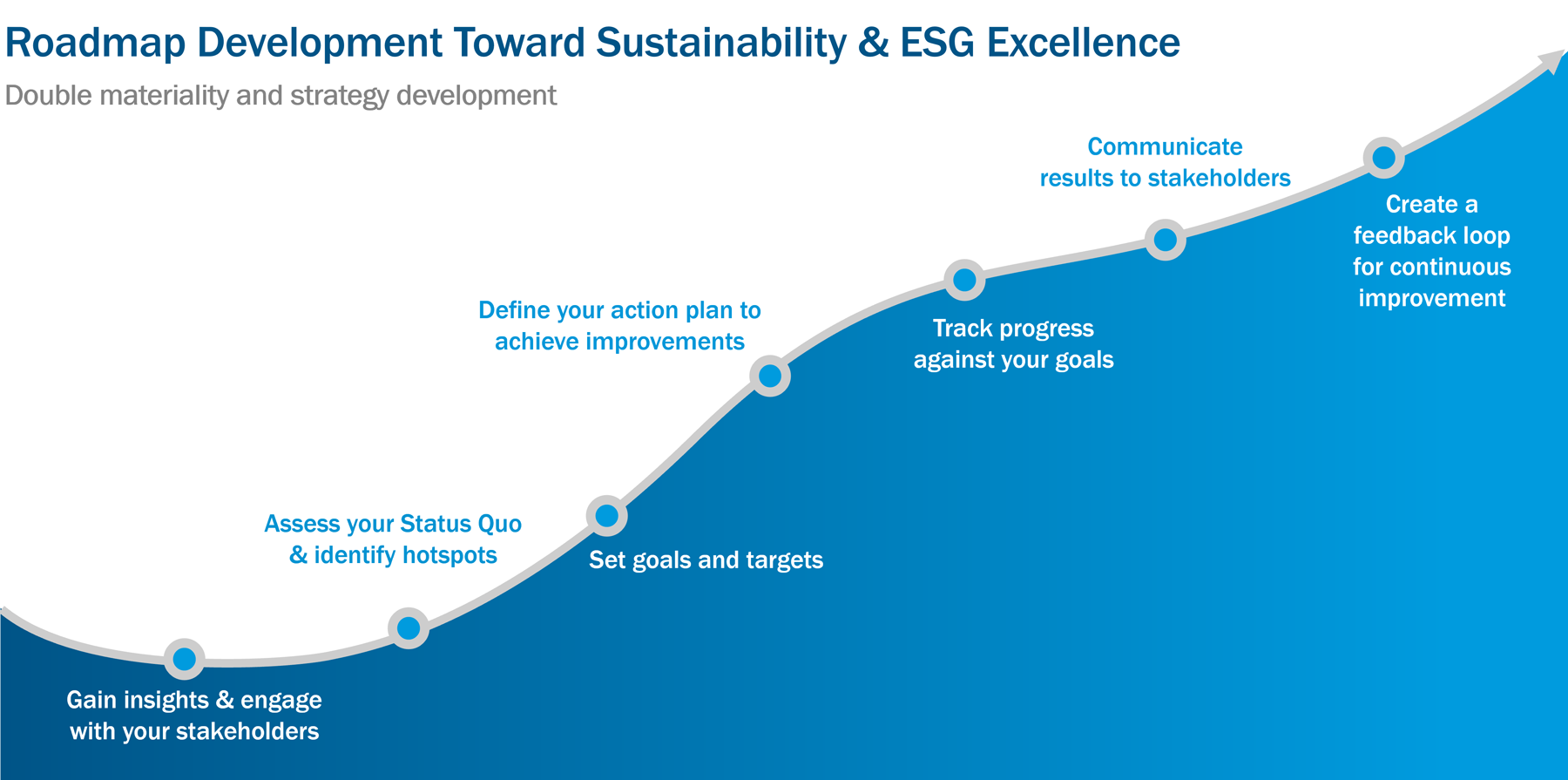

Integrating Materiality Results in a Sustainability Roadmap

As mentioned, double materiality is crucial to building a successful sustainability roadmap. Once the material topics are identified, assessed and prioritized, the next step is to set specific business goals and sustainability targets. These must be followed by concrete actions to achieve them. This is the ultimate aim of any materiality assessment.

The idea is to create a virtuous cycle of continuous improvement by analyzing actions and measures based on their degree of completion and the deviations from the targets. A materiality assessment is a dynamic exercise and needs to be reassessed periodically. This helps companies understand how the impacts evolve to accommodate the demands of investors and other stakeholders.

Source: Sphera

In other words, double materiality adds more substance to material impact and sustainability topics. It creates a tangible and action-oriented roadmap to prevent and mitigate negative impacts. Going a step further, it fosters activities that benefit the environment, people, economy and the company.

Double Materiality and ESG Strategy

To illustrate the benefits of a sustainability roadmap, let’s return to our previous example about E-Car Inc. The results of the impact materiality assessment led the company to prioritize topics such as supplier social assessment and child labor. From a financial perspective, E-Car Inc. quantified the impacts on the company’s financial performance and introduced measures focused on remediation and mitigation.

To effectively manage both types of material topics, the company identified the need to strengthen its governance practices related to human rights due diligence. It established procurement practices to mitigate human rights-related risks in the supply chain. The management of E-Car Inc. set specific requirements for all existing and new suppliers. For example, suppliers will be required to conduct social supplier assessments that include the topics of child labor and forced or compulsory labor.

In addition, as mitigation in the regions where the raw material for its batteries is sourced, E-Car Inc. will intensify its efforts to engage with the local community. Measures include investing a dedicated budget in youth development programs. The company is also creating a local community grievance process to mitigate the risks of negative impacts.

How Sphera Can Help with Double Materiality Assessments

Sphera has been integrating the double materiality approaches into our materiality assessments for many years and has developed a specific solution to help companies achieve CSRD compliance. We have supported thousands of companies in their sustainability reporting, many with materiality and double materiality assessments.

Sphera’s expertise spans all major industries, including energy, chemicals, textiles, automotive, fuels, metals, transport, electronics, construction and agriculture. In this sense, Sphera covers the ESG spectrum and has vast experience in supporting companies in audit-proof ESG reporting according to recognized standards, such as GRI (GRI-certified consultants), ISSB-SASB and now CSRD.

Sphera’s sustainability consulting team has been working on environmental, social and governance sustainability issues for more than 30 years. We help organizations build robust sustainability roadmaps and support the global economy on their way to a more sustainable future.