As the trajectory of climate risks and related costs continues to rise, regulatory bodies increasingly expect organizations to report on the impacts to their business. To support these reporting efforts, the Task Force on Climate-related Financial Disclosures (TCFD) has developed a framework of recommendations for assessing the risks, opportunities and financial impacts of climate change.

The TCFD recommendations have a dual purpose. On the one hand, they provide guidelines for organizations on preparing information for investors, lenders and insurers who allocate capital and underwrite risk. On the other hand, the recommendations serve as a tool for the organization’s management to assess business resilience and build a solid strategic roadmap.

Key Characteristics of the TCFD

Released in 2017, the final TCFD report includes four core elements and 11 recommended climate-related disclosures designed to be applicable to firms across different sectors and jurisdictions. The following characteristics make the TCFD a fundamental framework in today’s sustainability and business landscape:

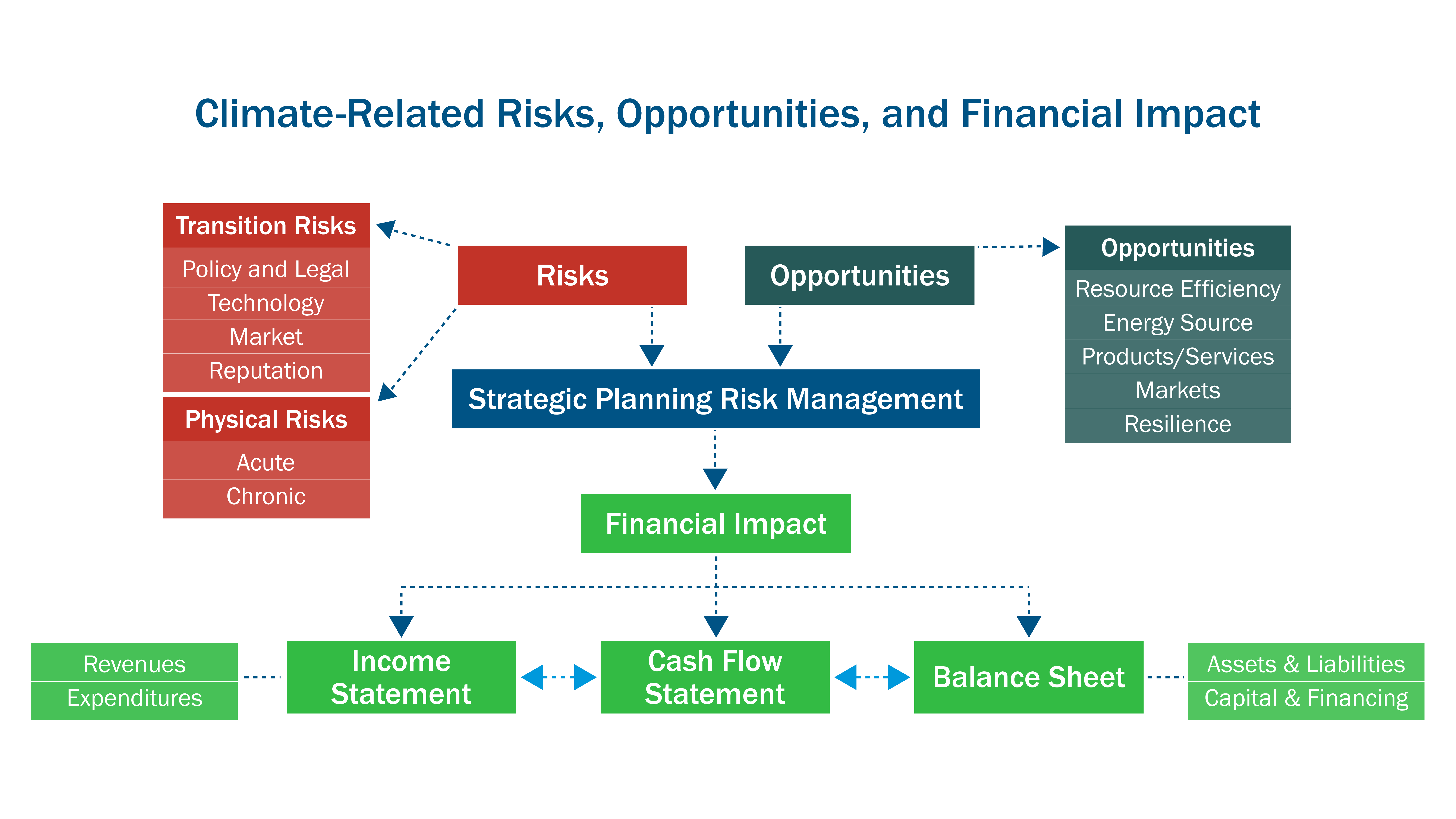

- The link between financial and non-financial information: The TCFD focuses on the financial impact of climate change. For example, a specific climate event could impact a firm’s financial performance by reducing its ability to generate revenue or affecting the sourcing of raw materials, thereby increasing its costs.

- Climate-related risks and opportunities: The TCFD highlights both physical and transition risks related to climate change. Physical risks may be acute, such as those driven by extreme weather events, or chronic risks resulting from long-term climate shifts. Transition risks refer to those related to the transition to a lower-carbon economy. The Task Force defines four transition risk categories: policy and legal, technology, market and reputation. The TCFD also identifies climate-related opportunities, including resource efficiency, energy source shifts and related savings on energy costs, low-emission products and services, as well as new markets and climate resilience.

- Time horizons: The impacts of climate change are already visible and, based on scientific projections, are likely to worsen. The TCFD encourages firms to define their time horizons and develop an understanding of the short-, medium- and long-term impacts.

- Scenario analysis and forward-looking assessments: A scenario describes a path of development leading to a particular outcome. Scenario analysis is a method for developing input to strategic plans to enhance plan flexibility or resilience to a range of future states. In its report, the TCFD provides advice and information on using this tool.

- Financial filings: The TCFD recommends that organizations disclose climate-related financial information and any findings from scenario analyses in their annual financial filings.

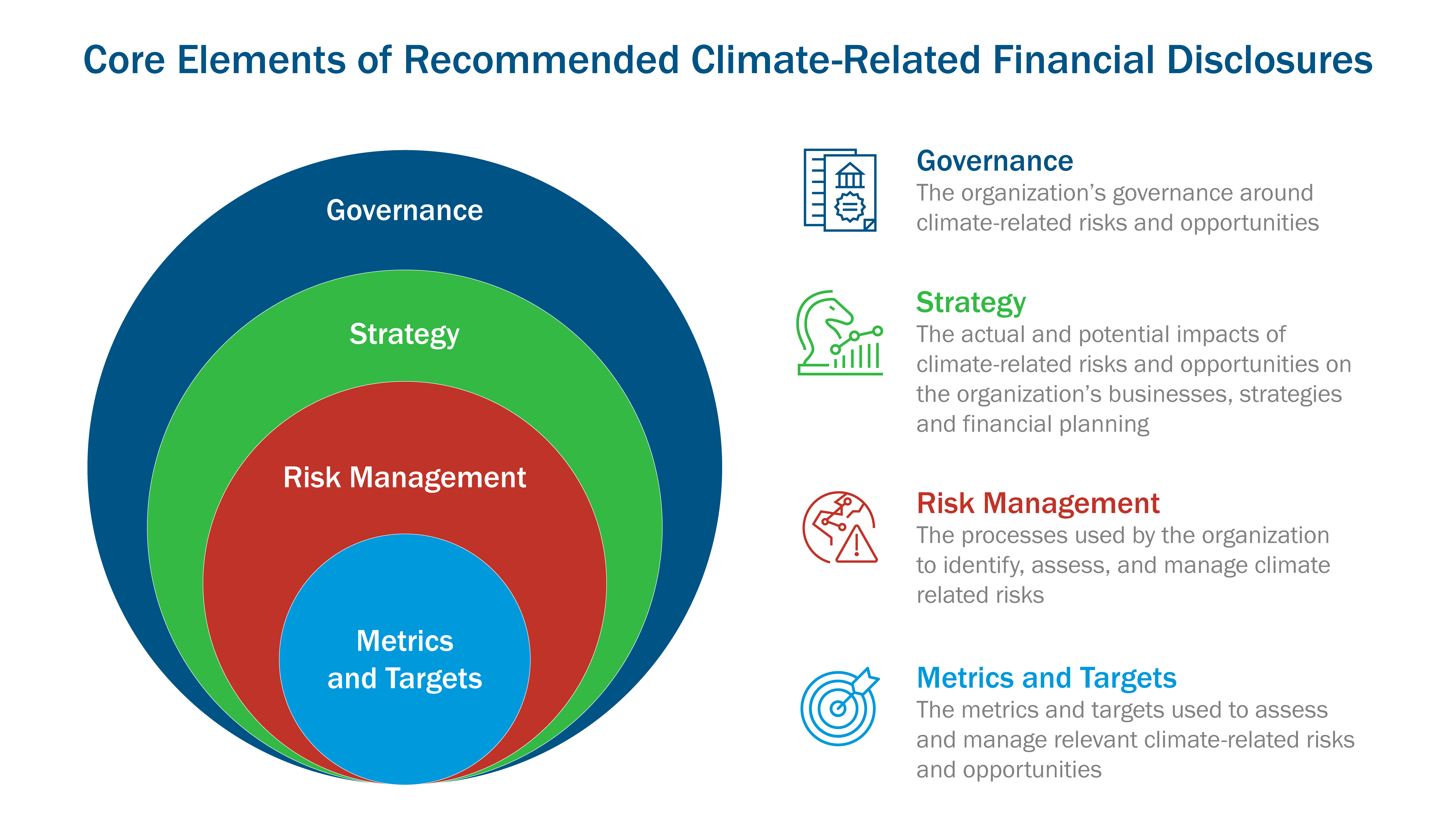

TCFD Recommendations for Climate-related Financial Disclosures

The TCFD recommendations focus on four key thematic areas: governance, strategy, risk management and metrics and targets. According to the report, each recommendation:

- Is adoptable by all organizations.

- Should be included in financial filings.

- Is designed to solicit decision-useful, forward-looking information on financial impacts.

- Has a strong focus on risks and opportunities related to the transition to a lower-carbon economy.

Below are the TCFD’s high-level recommendations for each category, along with specific recommended disclosures that companies should include in their financial filings:

- Governance: Disclose the organization’s governance around climate-related risks and opportunities. The recommended disclosures are:

a. Describe the board’s oversight of climate-related risks and opportunities.

b. Describe management’s role in assessing and managing climate-related risks and opportunities. - Strategy: Disclose the actual and potential impacts of climate-related risks and opportunities on the organization’s business, strategy and financial planning where such information is material. The recommended disclosures are:

a. Describe the climate-related risks and opportunities the organization has identified over the short, medium and long term.

b. Describe the impact of climate-related risks and opportunities on the organization’s business, strategy and financial planning.

c. Describe the resilience of the organization’s strategy, considering different climate-related scenarios, including a 2°C or lower scenario. - Risk Management: Disclose how the organization identifies, assesses and manages climate-related risks. The recommended disclosures are:

a. Describe the organization’s processes for identifying and assessing climate-related risks.

b. Describe the organization’s processes for managing climate-related risks.

c. Describe how processes for identifying, assessing and managing climate-related risks are integrated into the organization’s overall risk management. - Metrics and Targets: Disclose the metrics and targets used to assess and manage relevant climate-related risks and opportunities where such information is material. The recommended disclosures are:

a. Disclose the metrics used by the organization to assess climate-related risks and opportunities in line with its strategy and risk management process.

b. Disclose Scope 1, 2 and 3 greenhouse gas (GHG) emissions and related risks.

c. Describe the targets used by the organization to manage climate-related risks and opportunities and performance against targets.

Why Work with Us?

Sphera’s sustainability consulting team has been working on environmental, social and governance (ESG) and sustainability issues for 30 years, helping organizations build a robust sustainability roadmap and supporting the global economy on its way to a more sustainable future. Sphera’s expertise spans all major industries, including electricity, chemicals, textiles, automotive, fuels, metals, transport, electronics, construction and agriculture. Sphera covers the spectrum of environmental, social and governance issues, and our consultants have vast experience in supporting companies with climate-related reporting frameworks such as the TCFD.

Sphera has served more than 7,000 customers and has supported many of those by conducting TCFD assessments. We integrate climate-related risks and opportunities across our service offerings by helping firms quantify financial impacts and determine the cost of mitigation actions.