Overview

GLP Capital Partners (GCP) is a leading global alternative asset manager that invests primarily through real asset and private equity strategies. They are focused on high conviction and new fast-growing economy sectors such as logistics, data centers, renewable energy and its related technologies.

GCP’s ESG policies reflect their commitment to be responsible investors and incorporate ESG priorities into their decision-making throughout the life cycle of their investments. In fulfilling their ESG commitments, GCP encountered lengthy, localized and manual processes for managing and calculating their ESG data—in particular, greenhouse gas (GHG) emissions data—and measuring progress.

GCP used Excel, Power BI and SharePoint-linked visualization for data collection and management, all powered within an Azure environment. In 2021, they turned to ERM to help develop contemporary processes and drive digital transformation of the firm’s ESG initiatives.

Founded in: 2011

Investment management

Singapore

GCP’s Challenges

Difficult to scale reporting

using multiple versions of spreadsheets and reporting requirements for a variety of stakeholders.

Data collection inefficiencies and data quality concerns

regional localization issues from 3,000 operational properties across 17 countries and regional business unit localization issues, including multiple languages.

Aligning to industry standards

such as: GRESB Real Estate Assessment, Task Force on Climate-related Financial Disclosures (TFCD) and Sustainable Finance Disclosure Regulation (SFDR).

Emissions calculations

the complexity of calculations needed to determine carbon emissions footprint across all assets.

Solution

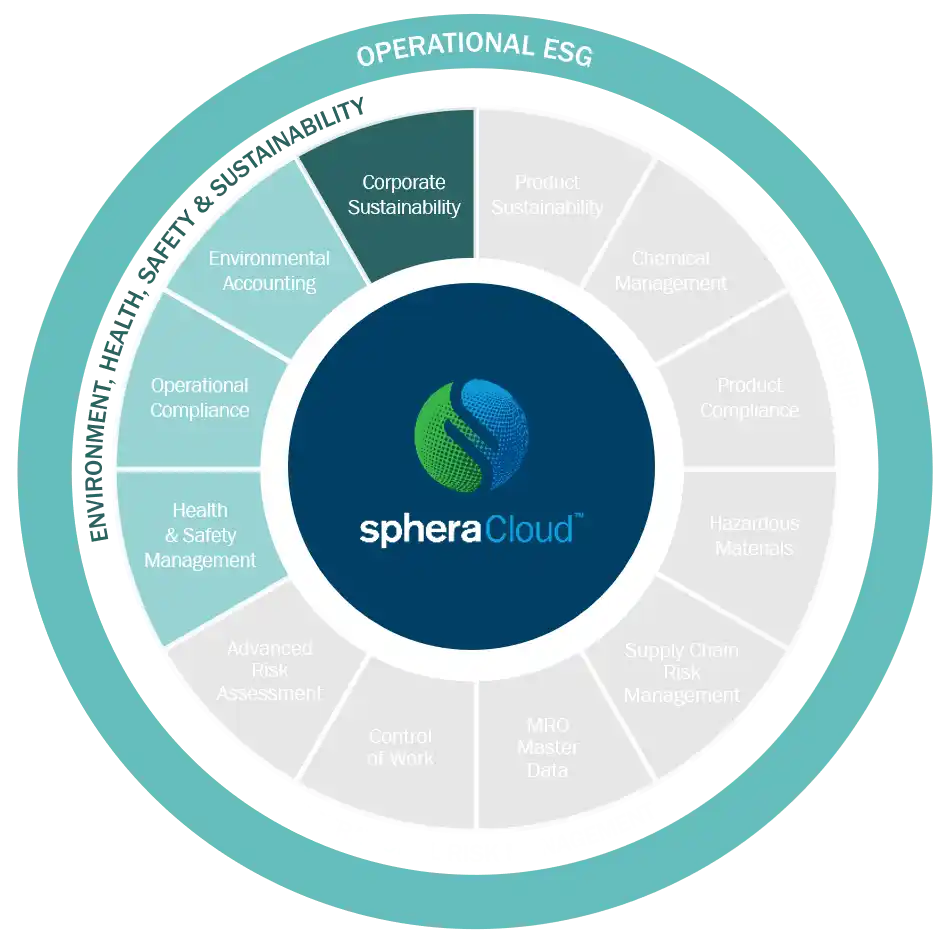

SpheraCloud Corporate Sustainability

GLP Capital Partners engaged ERM to streamline their processes, so they could better collect and measure the impact from their ESG data. This included the development of an ESG strategy and roadmap.

With evaluation and assessment guidance from ERM, GCP narrowed the field from 14 potential ESG software providers to three finalists, from which SpheraCloud Corporate Sustainability (SCCS) emerged as the most robust solution.

To meet the key challenges GCP faced, they continued to engage ERM on the implementation of SCCS to help them meet their ESG reporting objectives.

“The greatest reward in using the SpheraCloud Corporate Sustainability with ERM services is being able to see our overall ESG Strategy improve as we now have more control over our data and are able to reduce the number of times we ask for data, making it much easier to meet requirements from frameworks, regulators, and our investors.”

— Meredith Balenske, Global Head of Sustainability and ESG, GCP

Results

SpheraCloud’s Corporate Sustainability software along with ERM’s Digital Services and Sustainability teams have enabled GCP to scale the efficiency of their ESG initiatives, optimize data collection and reliability, improve reporting and distribution automation, manage expenses and provide increased transparency. This has helped GCP demonstrate progress toward fulfilling their environmental impact commitment.

Significant savings in cost and effort

Process enhancements

Improved ability to meet ESG frameworks

Better data quality

Read more about GCP’s development of an ESG strategy and roadmap with SpheraCloud Corporate Sustainability .

Are you ready to start your Corporate Sustainability journey?

Learn more about what SpheraCloud can do for your Corporate Sustainability.