Are you feeling overwhelmed by the growing stack of regulations your business needs to comply with? You’re not alone. In all corners of the world, companies are facing growing regulatory pressures and the need to expand their compliance effort.

Developing a robust compliance program is not a one-time sprint—it’s an iterative journey. Each step requires specific investments of time, money and resources. The costs can vary depending on your company’s unique compliance needs. However, as regulatory compliance becomes more complex, more tools and solutions are becoming available to help you navigate this landscape. And savings from avoidance of compliance issues and associated direct and indirect costs can well exceed the costs of a robust compliance program.

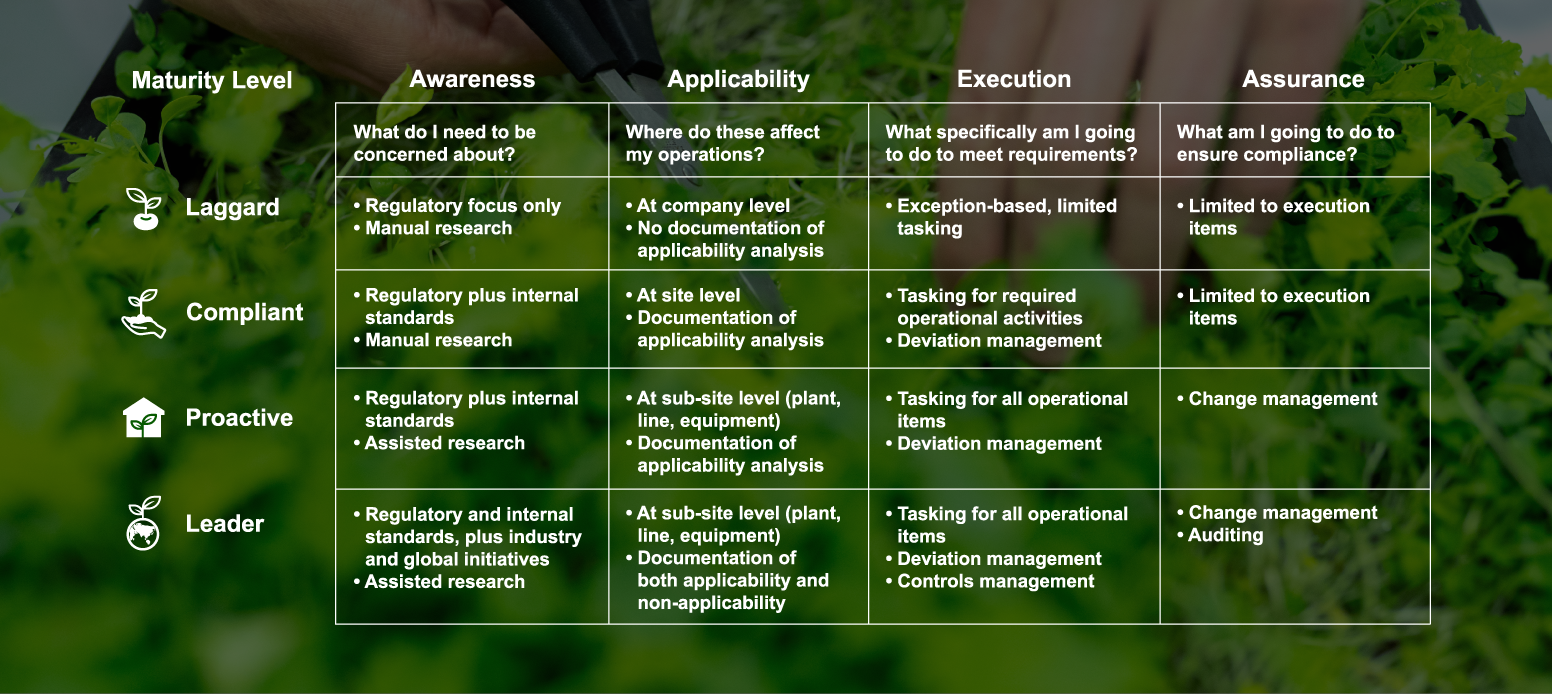

Four phases of compliance maturity

This blog delves into the four steps of a compliance maturity journey and describes the maturity level in terms of awareness, applicability, execution and assurance:

Phase 1: LAGGARD

At the start, some companies may find themselves at the lowest level of compliance maturity. This can be thought of as a starting point where there is no organized plan to follow the rules. Everything happens reactively.

- No formal structure: Companies don’t have a proper plan for following rules. Only the more common regulatory requirements are considered.

- Low awareness: People in the company might not even know much about the rules. Following them is seen as just another administrative burden, rather than part of operations.

- No documentation: There’s no record of looking into which rules apply to the company. Often knowledge exists only in the minds of workers and is not captured in any reference system.

- Reactive approach: Instead of being prepared, the workforce only reacts when things go wrong.

Phase 2: COMPLIANT

As companies grow on the maturity curve, they understand compliance standards. The relevant teams are more organized and prepared to make sure everyone in the company knows about compliance monitoring and management.

- Establishment of a compliance system: Still focused on regulatory, but now also includes internal standards. Research is still done manually.

- Expanded applicability: Applicability of requirements is documented at a site level.

- Compliance procedures: There are now clear instructions on how to follow compliance rules and processes and ensure compliance documentation.

- Get everyone on board: With communication and training, there is a better understanding around why compliance matters. This begins the transition to operational compliance, where compliance becomes embedded into everyday operations.

- Being proactive: Instead of waiting for problems to happen, tasks are performed to check for issues before they become a problem.

Phase 3: PROACTIVE

In the proactive stage of compliance maturity, companies elevate their compliance governance. It requires commitment and investment, but the payoff is substantial. Reduced risk, improved efficiency and a resilient, future-proof organization are just a few of the rewards.

- Integration everywhere: Compliance is built into every corner of the company.

- Culture of compliance: Compliance is practiced as part of the corporate culture; it’s not just about ticking boxes. Compliance requirements are applied down to the equipment level and are fully documented.

- Responsibility at all levels: Management and employees share responsibility for compliance, and compliance management and execution is set up for all operational items.

- Continuous improvement: Regular compliance auditing measures the level of compliance maturity. Where applicable, such auditing includes management of change and suggestions for improvement.

Phase 4: LEADER

In this advanced stage, companies show strong awareness of regulations, internal standards and industry best practices. They actively benchmark with industry leaders, using innovative technologies such as automated controls management and AI for risk assessment. For such companies, compliance becomes a strategic advantage. Embracing innovation and a comprehensive compliance strategy helps organizations stay competitive, building a foundation for sustainable growth.

- A comprehensive view: Compliance covers not just legal requirements, but also internal standards, industry best practices and global initiatives, creating a holistic framework for sustainable operations.

- Benchmarked excellence: Learning from leaders and adopting compliance best practices (e.g., change management, audits, etc.) for continuous improvement.

- Granular understanding: Clearly documents applicability and non-applicability at the sub-site level for audit readiness.

- Innovation fuels efficiency: New technologies and methods are embraced to streamline processes, automate tasks and gain deeper insights into potential risks.

- Competitive advantage: Sees compliance as a trust-building differentiator for stakeholders.

Transforming compliance: from siloed regulation to operational integration

Now that the various stages have been clearly outlined, the question remains: how to begin the transformation? How do organizations move from disconnected regulatory activities to embedding compliance in daily operations? We recommend these initial steps:

Establish a compliance framework and processes:

- Create a compliance program, with defined processes and clear responsibilities.

- Ensure independence of the compliance function for unbiased oversight.

- Integrate compliance checks into operational processes.

- Use software tools to automate routine compliance tasks and manage compliance documentation.

Build a compliance culture:

- Anchor compliance values in the company’s mission and vision.

- Promote open and transparent communication.

- Regularly train and sensitize workers to compliance issues.

- Empower workers to address issues rather than look the other way.

Develop and implement improvement actions:

- Conduct both internal and external audits.

- Identify and prioritize improvement opportunities.

- Develop and implement action plans.

Continuously monitor and measure effectiveness:

- Track progress against key performance indicators (KPIs).

- Evaluate the effectiveness of implemented actions.

- Adjust plans as needed to ensure continuous improvement.

By taking these initial steps, companies can begin the journey toward a more mature and integrated compliance management program. This will ultimately strengthen their risk management, operational efficiency, compliance assurance and reputation.

Our team of compliance experts can be your trusted partner at every stage. Whether you are starting a new compliance program or seeking to enhance your current efforts, we can provide the guidance and purpose-built software that are necessary to achieve your goals.

With SpheraCloud Operational Compliance software, you can identify and manage compliance requirements, automate tasks and build a transparent, auditable record. When you have the right software, proactive risk mitigation and streamlined processes become your reality.

Contact us today to learn more about how we can help you transform your compliance program and build a foundation for sustainable success.