Below are the TCFD’s high-level recommendations for each category, along with specific recommended disclosures that companies should include in their financial filings:

- Governance: Disclose the organization’s governance around climate-related risks and opportunities. The recommended disclosures are:

a. Describe the board’s oversight of climate-related risks and opportunities.

b. Describe management’s role in assessing and managing climate-related risks and opportunities.

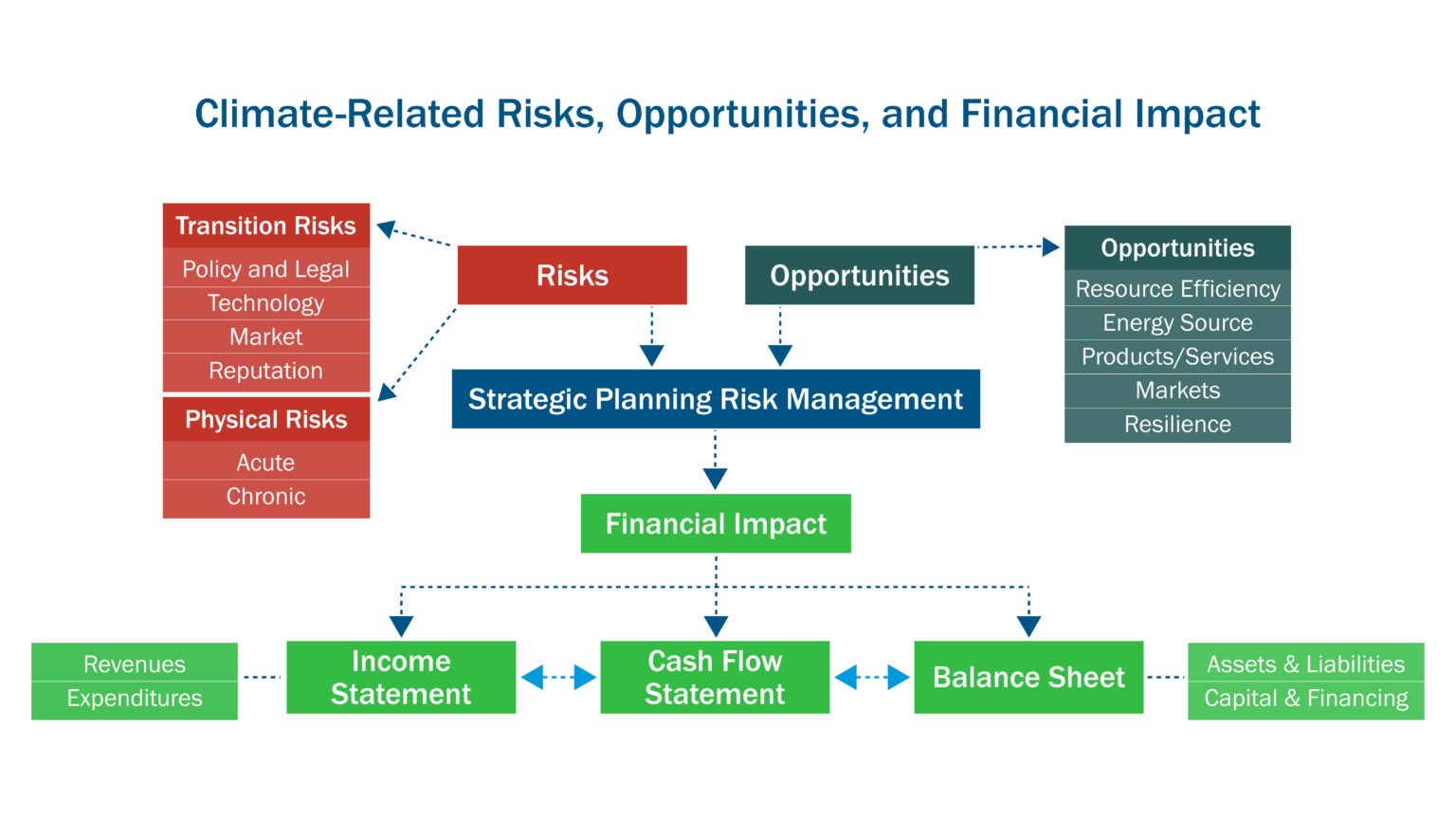

- Strategy: Disclose the actual and potential impacts of climate-related risks and opportunities on the organization’s business, strategy and financial planning where such information is material. The recommended disclosures are:

a. Describe the climate-related risks and opportunities the organization has identified over the short, medium and long term.

b. Describe the impact of climate-related risks and opportunities on the organization’s business, strategy and financial planning.

c. Describe the resilience of the organization’s strategy, considering different climate-related scenarios, including a 2°C or lower scenario.

- Risk Management: Disclose how the organization identifies, assesses and manages climate-related risks. The recommended disclosures are:

a. Describe the organization’s processes for identifying and assessing climate-related risks.

b. Describe the organization’s processes for managing climate-related risks.

c. Describe how processes for identifying, assessing and managing climate-related risks are integrated into the organization’s overall risk management.

- Metrics and Targets: Disclose the metrics and targets used to assess and manage relevant climate-related risks and opportunities where such information is material. The recommended disclosures are:

a. Disclose the metrics used by the organization to assess climate-related risks and opportunities in line with its strategy and risk management process.

b. Disclose Scope 1, 2 and 3 greenhouse gas (GHG) emissions and related risks.

c. Describe the targets used by the organization to manage climate-related risks and opportunities and performance against targets.

Why Work with Us?

Sphera’s sustainability consulting team has been working on environmental, social and governance (ESG) and sustainability issues for 30 years, helping organizations build a robust sustainability roadmap and supporting the global economy on its way to a more sustainable future. Sphera’s expertise spans all major industries, including electricity, chemicals, textiles, automotive, fuels, metals, transport, electronics, construction and agriculture. Sphera covers the spectrum of environmental, social and governance issues, and our consultants have vast experience in supporting companies with climate-related reporting frameworks such as the TCFD.

Sphera has served more than 7,000 customers and has supported many of those by conducting TCFD assessments. We integrate climate-related risks and opportunities across our service offerings by helping firms quantify financial impacts and determine the cost of mitigation actions.