3. Scenario-Based Evaluation of Physical Asset Risk

To meet today’s requirements—and to be ready for tomorrow’s—firms must be able to conduct complex climate scenario analyses and quantify distinct risks and opportunities across a broad range of industry-specific, geographic, supply-chain and product related factors. The TCFD’s scenario analysis criteria help companies create these scenarios for strategic planning and climate risk reporting. Sphera’s Sustainability Consulting team helps customers develop climate risk assessments using our Corporate Sustainability software. Customers can model climate risk, water scarcity and waste-mitigation and highlight distinct areas of concern — not just from a current and past perspective but also from a predicted-future scenario. Local asset-level climate risks such as water stress, sea-level rise and cyclones / hurricanes are tracked, as are transition risks based on local legal requirements and / or technological limitations. Projected risk data can be isolated or integrated for each operating site. Using the software’s action and target module, firms can identify, map, prioritize and monitor climate change mitigation actions, investments, carbon savings and related carbon price at a granular level matched to site or further aggregated all the way up to a company level. The core product functionality includes a full report generator, enabling data visualizations on a daily, monthly, quarterly, half yearly or yearly basis. The software also provides state-of-the-art business intelligence (BI) analytics, leveraging a sophisticated database and several advanced calculation engines.

4. Financial Management Functionality

TCFD recommendations require companies to accurately apply an internal carbon price to distinct business activities, purchased services and raw materials. Additionally, for the financial sector to comply with reporting requirements based on TCFD recommendations, banks, investors and asset managers must be able to calculate, understand and manage financed emissions across their portfolios.

SpheraCloud Corporate Sustainability enables visualization of financial data on a daily, monthly, quarterly, semi-annual or annual basis. Reports are also supported for any hierarchy level or parameter — and they can be created instantly and intuitively by any user with the appropriate permissions. Structures for organizational entities and cross-functional measures (like carbon reporting KPIs) can be tailored by the customer to allow different reporting focus areas — for example, distinct carbon reporting KPIs pertaining to EU taxonomy and the Sustainable Finance Disclosure Regulation. As noted above, our Corporate Sustainability software provides state-of-the-art business intelligence analytics, and with the addition of the upcoming PCAF (Partnership for Carbon Accounting Financials) module, Sphera’s software will bring its breadth of analysis and expertise to the financial sector. The new functionality will further divide Scope 3 Category 15 into distinct asset classes — each with their required methods and data granularity for measuring financed emissions. This will enable financial institutions to efficiently calculate the financed emissions of any existing or potential investment; stress-test risk and controls; and build more effective strategy and transition plans. Experience has repeatedly shown us that better measurements lead to better strategies, and better strategies lead to better actions and execution.

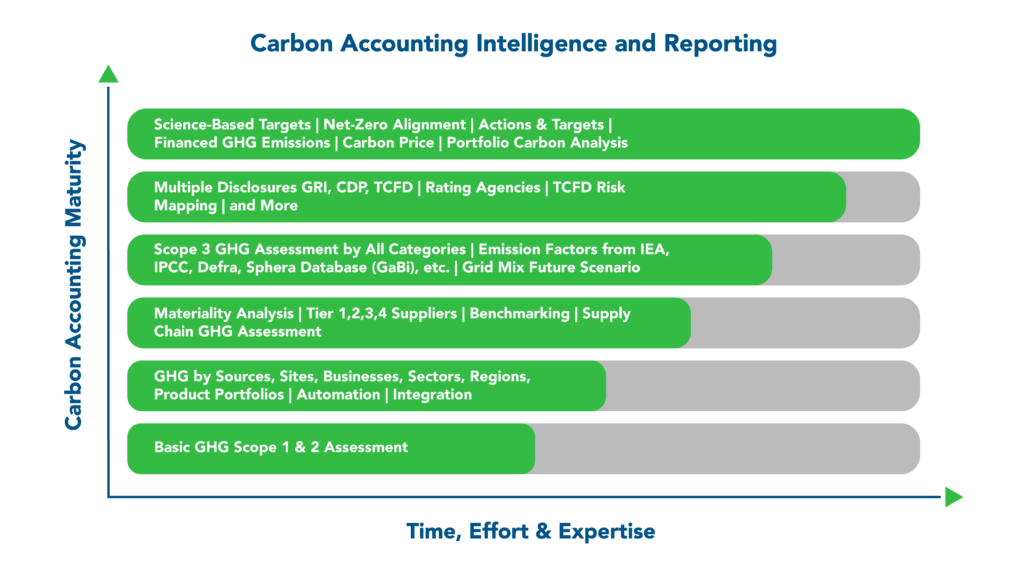

5. Net-Zero Strategy Development and Program Implementation

At a high level, organizations need insights and software to efficiently accommodate and respond to change. Sphera’s sustainability consultants bring a wealth of relevant knowledge to enable this change. They advise clients on defining net-zero objectives and strategies, and they can also provide guidance for developing a climate strategy that is based on deep decarbonization for different sectors. Solutions need to enable tracking of enterprise-wide decarbonization projects that cover emissions associated with buildings, equipment, data centers and vehicle fleets. They also must accurately calculate upstream and downstream emissions associated with these changes.

Agreed-upon targets (Environmental, Social, Governance, Financial, etc.) can be tracked against any metric via the targets and actions module. In addition, the GHG mitigation actions required to achieve each target can be analyzed from a financial and risk perspective to fully inform investment decisions. The Sphera solution also allows organizations to respond in a coordinated, efficient manner by enabling them to define, plan, assess and track objectives at any level of the organizational hierarchy — applying the same detailed scenario analysis. Process continuities can be maintained or modified because the solution is highly configurable, allowing customers to implement current (or improved) workflows. Analytics provide feedback for tracking performance against targets with multiple scenarios — for example, Science-Based Targets based on a scenario of “well below 2 degrees C” or a 1.5-degree scenario. Financial information related to actions (renewable energy procurement, deployment of low carbon technologies, supplier engagement, circular economy product design, etc.) can be captured and analyzed to identify the combination of actions that ensure targets are met and optimal ROI is achieved.