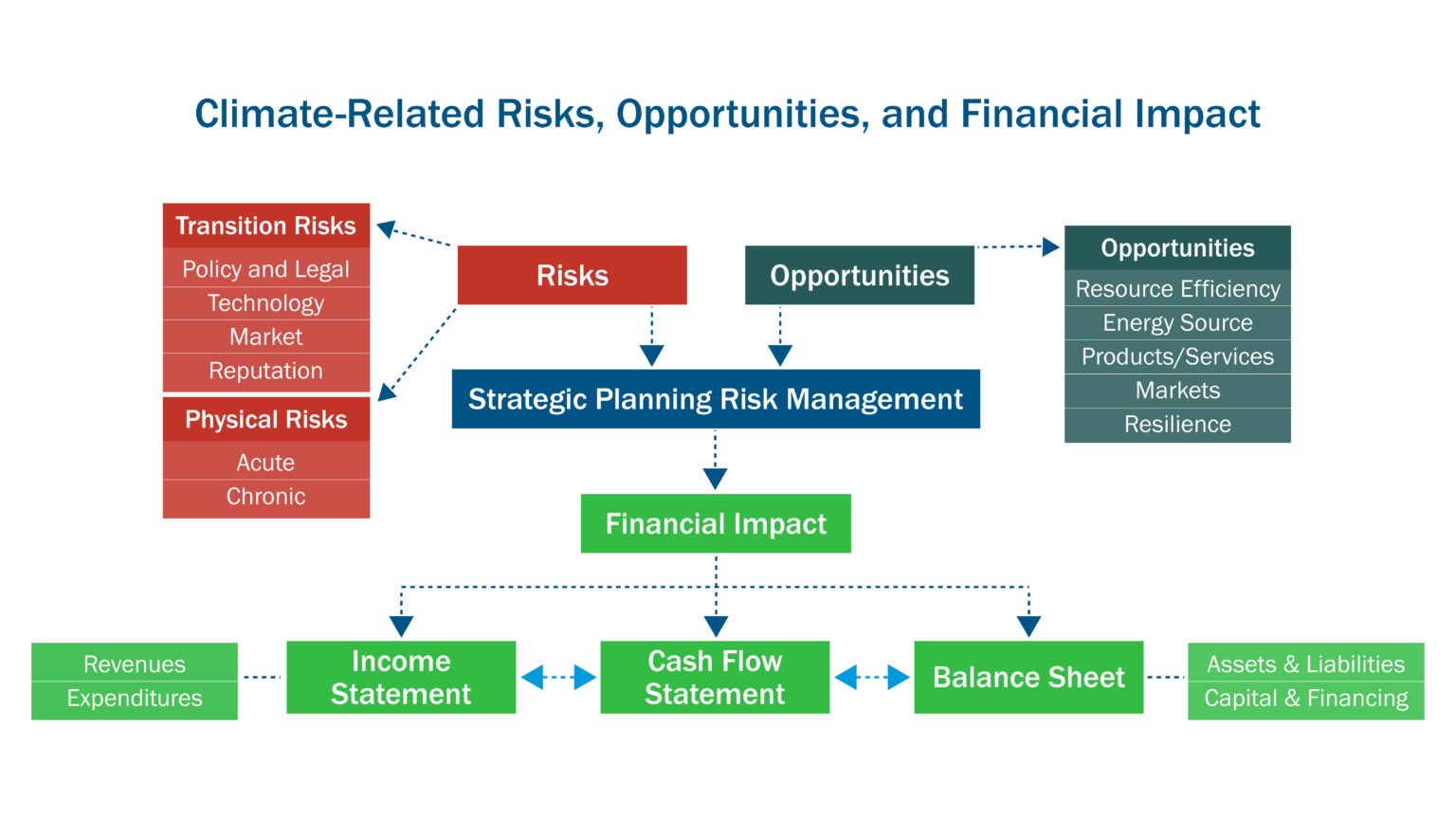

As the trajectory of climate risks and related costs continues to rise, regulatory bodies increasingly expect organizations to report on the impacts to their business. To support these reporting efforts, the Task Force on Climate-related Financial Disclosures (TCFD) has developed a framework of recommendations for assessing the risks, opportunities and financial impacts of climate change.

The TCFD recommendations have a dual purpose. On the one hand, they provide guidelines for organizations on preparing information for investors, lenders and insurers who allocate capital and underwrite risk. On the other hand, the recommendations serve as a tool for the organization’s management to assess business resilience and build a solid strategic roadmap.