Your Complete Guide to Supply Chain Sustainability

At the core of any supply chain sustainability plan, there are four main areas We show you how to take a deeper dive into each for guaranteed supply chain efficiency

Today, a company’s public image can rapidly diminish if they fail to comply with the increasingly prevalent environmental, social, and governance (ESG) standards being put into place worldwide.

One crucial area of business that all companies can address to achieve better sustainability is the supply chain. These are sophisticated global networks, external of the business itself, comprised of manufacturers, logistics enterprises, and third-party suppliers.

For too many years, they have been neglected as “out of sight, out of mind” by businesses. Yet according to McKinsey, a company’s supply chain accounts for far greater social and environmental impact than its own operations (80-90%, by some accounts).

So where do you start? At the core of any successful supply chain sustainability plan, there are four main areas:

- The breaking down of data siloes and subsequent goal setting

- Using supplier assessments to capture supply chain sustainability insights

- Building supplier relationships that drive lasting sustainability improvement

- Exploration into supply chain-wide collaboration

This guide will show you how to take a deeper dive into each of these four areas regardless of your current level of supply chain sustainability awareness.

Section One – Internal Alignment and Goal Setting

To implement an effective supply chain sustainability strategy, organizations must first discover where they can align internally and then work together to create goals. Information can be siloed in companies large and small, and data can be unreliable and disparate between departments.

Procurement is emerging as a particularly helpful and strategic function to sustainability efforts and setting supply chain sustainability goals. While spend and inventory management are undoubtedly the pinnacles of the function, procurement departments have been crucial in innovating new ways to acquire more reliable data and implement responsible sourcing processes.

Elevating procurement’s role before setting sustainability goals can be a useful and facilitative practice. Procurement can help organizations set KPIs that overarch between departments, improve collaboration within departments, and break down information siloes.

That being said, be sure to choose stakeholders from every major area to assist with goal setting (marketing, legal, compliance, CSR, etc.). Once you have identified who should be involved, it’s time to decide what matters most to your business and where you can take the most tangible actions.

Determine Which Sustainability Areas to Focus on

Depending on what your company does and how far into implementing a supply chain sustainability strategy you are, there are several different areas of focus. The three main aggregations of sustainability metrics are environmental, social, and governance. Each category has several subsections a business may choose to tackle.

For example, some organizations may choose to focus on eliminating deforestation and promoting biodiversity in their supply network. In contrast, another organization may focus on risk management and supplier DE&I.

It is critical to get every stakeholder to review all areas of ESG before distilling down to create goals and set KPIs.

Setting Goals and KPIs

There are two primary types of goals an organization may set. Both types use quantitative metrics but have slight differentiators.

- Absolute Goals are based on percentages and KPIs, such as reducing virgin plastics in your supply chain by 50% by the year 2025.

- Relative Goals are based on percentages and KPIs but in comparison to units, so reducing virgin plastics per unit of product sold by 75% by 2025.

It is recommended that when setting sustainability goals and KPIs, a business should align with the UN SDG Compass. By linking to a baseline, time, and goals, KPIs remain actionable, and there is a clear unit of measure to govern progress. A company may choose a point in time—a specific year—or a period of time, such as five years. Remaining realistic about what baseline will be attainable is key to making progress.

Once a company has determined ESG areas to focus on, aligned stakeholders, and set goals and KPIs, they can move on to assessing suppliers.

Section Two – Assessing Your Suppliers

Before an organization begins to collect data, it must define what data is needed. Based on the goals set in Section One, data will need to be collected from suppliers to ensure those goals are being met. For instance, a company might look for energy usage data to calculate Scope 3 emissions. Or proof of labor policies at the sub-tier level to ensure regulatory compliance.

How to Gather Data from Suppliers

There are two standardized ways to collect data from suppliers.

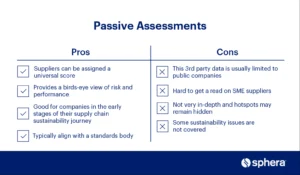

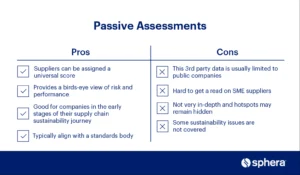

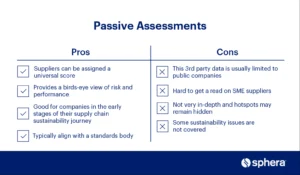

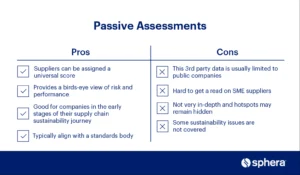

- Passive Assessments are universal scores based on existing data supplied from third-party data collectors and are particularly useful for companies just starting their supply chain sustainability journey.

- Active Assessments give more granular insights and have a bigger scope, collecting data directly from suppliers—they are typically used for more complicated multi-tier supplier networks.

Passive assessments, although not necessarily as detailed, can be an efficient use of resources. With a small amount of effort, companies can end up with an excellent first view of a supplier.

Active assessments, on the other hand, require a fair bit more effort, but generate more robust insights. With no international bodies collecting standardized data for you, it’s each company’s responsibility to collect specific data.

Both versions of assessments can be useful, depending on your KPIs and goals. Take time to remind yourself of the limitations and prerequisites of each before setting out on your supplier assessment journey.

It’s also important to note that companies can implement a hybrid model of both passive and active assessments.

A company could:

- Start by mapping their multi-tier supply chain

- Layer in 3rd party data to define risk hotspots by location (passive)

- Follow up with supplier assessments (active)

When a supplier is flagged as high-risk, it might be necessary to follow up an assessment with an onsite audit. Regardless of an assessment being passive or active, a boots-on-the-ground approach may be needed to collect firsthand information.

See how a company might navigate through its supplier assessment journey in the example below.

What is Multi-Tier Data and Why is it Important?

Many companies exclusively focus on their primary suppliers. But customers, as well as regulators, have started to inquire more deeply about where their products originate, all the way back to square one.

Multi-tier data comes from your second, third, and fourth-level suppliers, presenting you with a more holistic picture of your supply chain. After all, the most severe ESG violations often come from suppliers buried deep within your supply chain network.

Bottom line—collecting multi-tier data may be the most valuable thing your organization can do to reach its sustainability goals.

How to Approach Multi-Tier Assessments

Even though your first level of suppliers may be adhering to your code of conduct, the further down you get in your supply chain, the more often system pipelines break down, and ESG issues seep in through the cracks. Before they inundate your supply chain with risks, it pays to be proactive.

Yet, this alone comes with its own unique set of challenges:

- Tracking down who sub-suppliers actually are

- Building a tenuous foundation of trust

- Providing the tools these smaller suppliers need to understand and monitor ESG metrics

A solid approach is to first focus your efforts on the biggest risks in your sub-tier supply chain. Remember, you can’t tackle everything at once. Instead, focus on the suppliers that need your full support and attention. Perhaps these are the suppliers with the highest facility-level emissions intensity, or those who are not using any sustainably certified materials.

Not sure where to start? We’ve summarized some best practices and key things to consider for today’s most pressing supply chain sustainability issues. Browse through the graphics below!

Multi-Tier Hot Topics

Supplier Diversity

Tip: Tools like supplier.io and Tealbook provide databases of diverse suppliers for businesses to build new relationships with, but it’s equally important to build capacity with existing, non-diverse suppliers.

Scope 3 Emissions

Tip: Many suppliers don’t know how to calculate their emissions. On top of providing tools and resources to help them improve, ask for energy use data instead of emissions, which you can then use to calculate emissions intensity by spend.

Plastics

Tip: It may not be realistic to ask your suppliers to eliminate all plastics at once. Start by cutting back on single-use and virgin plastics.

Section 3 – Collaborating with your Suppliers to Improve

By this phase, you’ve aligned on your goals, collected supplier sustainability data, and uncovered your biggest risks. Now it’s time to take action, and that involves engaging with your suppliers.

Supplier engagement is urgently needed to create lasting impact, but unfortunately, doing it right is easier said than done. True engagement is more than simply sending out data requests to your suppliers.

Instead, it should be thought of as journey. Beforehand, organizations should prepare their suppliers for what is coming and ensure everyone is aware of what is needed. While collecting sustainability data from suppliers, organizations must provide support and issue reminders. Once assessments are complete, organizations should share results and co-create ideas for improvement, providing suppliers with the tools and resources to do so.

Supplier Engagement Varies

Supplier engagement is not a one-size-fits-all approach, so companies must adapt their engagement strategies depending on the supplier. Each supplier is at its own stage in sustainability, and companies must factor in a supplier’s size, region, product category, etc., before engaging.

Some engagement strategies will also need to be governed by the importance of the issue at hand and the priority level of the particular sustainability goal. If Scope 3 is an area of focus for your business, then suppliers that have the greatest emissions footprint would be a priority engagement.

Maximize Value to Scale Supplier Engagement

Keep in mind that your engagement and improvement efforts won’t go very far if you haven’t built a two-way street relationship with you suppliers. Not only do your suppliers need to trust the data collection process, but they should also be getting value from participating in your initiative. Your suppliers are likely dealing with hundreds of data requests per year, so if you’re constantly requesting data without providing anything in return, participation rates will inevitably falter.

Supplier value can come in a variety of forms. One great way to make the assessment process valuable for your suppliers is to share back the results, so they know where they stand in relation to their peers. Or, value can come in the form of offering preferential terms or more favorable contracting. An emerging practice is offering sustainable financing solutions to suppliers, giving them the ability to make the necessary infrastructure or equipment upgrades to meet your goals.

At the very minimum, your assessment initiative should reduce survey fatigue and be as standardized as possible. Supplier sustainability tech platforms can help scale this process, allowing information to be pre-populated and easily shared to multiple customers. For an overview of the market and its key players, check out the Gartner Market Guide for Supplier Sustainability Applications.

Section 4 – Collaborating for a More Sustainable Future

Another crucial ingredient for increasing the adoption of sustainable supply chains is industry-wide collaboration. In the context of responsible sourcing, multi-sector collaboration on a particular issue or category helps normalize a standardized approach for measuring and reporting on supplier sustainability performance.

Utilizing a standardized approach has a myriad of benefits for both you and your suppliers. For you, standardization saves time and resources, and often is associated with higher supplier response rates. For your suppliers, standardization significantly decreases burden. With so many different methodologies and frameworks out there, it can be challenging to get suppliers to engage in sustainability initiatives, especially if they’re small and strapped for resources.

That being said, a standard assessment may not give your company the information you need—customization has certain advantages that cannot be ignored.

Breakdown of Standard Assessments

Pros

- Encourages more widespread adoption of responsible sourcing practices

- Reduces burden on suppliers

- Easier to track performance over time

- Frees up time for value-added activities such as driving improvement with suppliers

Cons

- May not address your company’s specific needs

- May not provide granular enough information

Custom Assessment Breakdown

Pros

- Let’s you capture more meaningful data

- Ideal when there is no set industry standard

Cons

- Limits adoption of industry standardized approaches for measuring and reporting on sustainability performance

- Increases burden on suppliers

- Reduces industry collaboration

Our advice? Use a standardized approach wherever possible, and if you need more specific information, supplement with custom questions.

Industry Group Roundup

Businesses that want to accelerate their supply chain sustainability practices and promote standardization should collaborate with industry groups. Luckily, there are already well established groups in every business vertical and sustainability topic, from apparel to CPGs.

Take some time to familiarize yourself with the specific industry groups that will be able to help you standardize, access information, and provide resources to your suppliers. Some great examples include The Sustainability Consortium, which has created a platform for consumer goods retailers and suppliers to come together to increase product sustainability, and the Sustainable Apparel Coalition, which has developed a robust suite of tools to standardize supply chain sustainability in apparel, footwear, and textiles.

Putting the Pieces Together

To summarize, to build a sustainable supply chain, we recommend you focus on four main areas.

- Unify data and break down silos, understanding the critical role of procurement and setting company-wide sustainability goals.

- Utilize supplier assessments to identify your biggest risks and opportunities, making sure you know the difference between passive and active methods and when to employ each, and asking targeted questions of all tiers of suppliers.

- Turn your data into action by engaging your suppliers and creating a supplier sustainability improvement roadmap.

- Collaborate with companies in your industry, drive innovation in groups, and use shared resources to champion supply chain sustainability.

Your Complete Guide to Supply Chain Sustainability

At the core of any supply chain sustainability plan, there are four main areas We show you how to take a deeper dive into each for guaranteed supply chain efficiency

Today, a company’s public image can rapidly diminish if they fail to comply with the increasingly prevalent environmental, social, and governance (ESG) standards being put into place worldwide.

One crucial area of business that all companies can address to achieve better sustainability is the supply chain. These are sophisticated global networks, external of the business itself, comprised of manufacturers, logistics enterprises, and third-party suppliers.

For too many years, they have been neglected as “out of sight, out of mind” by businesses. Yet according to McKinsey, a company’s supply chain accounts for far greater social and environmental impact than its own operations (80-90%, by some accounts).

So where do you start? At the core of any successful supply chain sustainability plan, there are four main areas:

- The breaking down of data siloes and subsequent goal setting

- Using supplier assessments to capture supply chain sustainability insights

- Building supplier relationships that drive lasting sustainability improvement

- Exploration into supply chain-wide collaboration

This guide will show you how to take a deeper dive into each of these four areas regardless of your current level of supply chain sustainability awareness.

Section One – Internal Alignment and Goal Setting

To implement an effective supply chain sustainability strategy, organizations must first discover where they can align internally and then work together to create goals. Information can be siloed in companies large and small, and data can be unreliable and disparate between departments.

Procurement is emerging as a particularly helpful and strategic function to sustainability efforts and setting supply chain sustainability goals. While spend and inventory management are undoubtedly the pinnacles of the function, procurement departments have been crucial in innovating new ways to acquire more reliable data and implement responsible sourcing processes.

Elevating procurement’s role before setting sustainability goals can be a useful and facilitative practice. Procurement can help organizations set KPIs that overarch between departments, improve collaboration within departments, and break down information siloes.

That being said, be sure to choose stakeholders from every major area to assist with goal setting (marketing, legal, compliance, CSR, etc.). Once you have identified who should be involved, it’s time to decide what matters most to your business and where you can take the most tangible actions.

Determine Which Sustainability Areas to Focus on

Depending on what your company does and how far into implementing a supply chain sustainability strategy you are, there are several different areas of focus. The three main aggregations of sustainability metrics are environmental, social, and governance. Each category has several subsections a business may choose to tackle.

For example, some organizations may choose to focus on eliminating deforestation and promoting biodiversity in their supply network. In contrast, another organization may focus on risk management and supplier DE&I.

It is critical to get every stakeholder to review all areas of ESG before distilling down to create goals and set KPIs.

Setting Goals and KPIs

There are two primary types of goals an organization may set. Both types use quantitative metrics but have slight differentiators.

- Absolute Goals are based on percentages and KPIs, such as reducing virgin plastics in your supply chain by 50% by the year 2025.

- Relative Goals are based on percentages and KPIs but in comparison to units, so reducing virgin plastics per unit of product sold by 75% by 2025.

It is recommended that when setting sustainability goals and KPIs, a business should align with the UN SDG Compass. By linking to a baseline, time, and goals, KPIs remain actionable, and there is a clear unit of measure to govern progress. A company may choose a point in time—a specific year—or a period of time, such as five years. Remaining realistic about what baseline will be attainable is key to making progress.

Once a company has determined ESG areas to focus on, aligned stakeholders, and set goals and KPIs, they can move on to assessing suppliers.

Section Two – Assessing Your Suppliers

Before an organization begins to collect data, it must define what data is needed. Based on the goals set in Section One, data will need to be collected from suppliers to ensure those goals are being met. For instance, a company might look for energy usage data to calculate Scope 3 emissions. Or proof of labor policies at the sub-tier level to ensure regulatory compliance.

How to Gather Data from Suppliers

There are two standardized ways to collect data from suppliers.

- Passive Assessments are universal scores based on existing data supplied from third-party data collectors and are particularly useful for companies just starting their supply chain sustainability journey.

- Active Assessments give more granular insights and have a bigger scope, collecting data directly from suppliers—they are typically used for more complicated multi-tier supplier networks.

Passive assessments, although not necessarily as detailed, can be an efficient use of resources. With a small amount of effort, companies can end up with an excellent first view of a supplier.

Active assessments, on the other hand, require a fair bit more effort, but generate more robust insights. With no international bodies collecting standardized data for you, it’s each company’s responsibility to collect specific data.

Both versions of assessments can be useful, depending on your KPIs and goals. Take time to remind yourself of the limitations and prerequisites of each before setting out on your supplier assessment journey.

It’s also important to note that companies can implement a hybrid model of both passive and active assessments.

A company could:

- Start by mapping their multi-tier supply chain

- Layer in 3rd party data to define risk hotspots by location (passive)

- Follow up with supplier assessments (active)

When a supplier is flagged as high-risk, it might be necessary to follow up an assessment with an onsite audit. Regardless of an assessment being passive or active, a boots-on-the-ground approach may be needed to collect firsthand information.

See how a company might navigate through its supplier assessment journey in the example below.

What is Multi-Tier Data and Why is it Important?

Many companies exclusively focus on their primary suppliers. But customers, as well as regulators, have started to inquire more deeply about where their products originate, all the way back to square one.

Multi-tier data comes from your second, third, and fourth-level suppliers, presenting you with a more holistic picture of your supply chain. After all, the most severe ESG violations often come from suppliers buried deep within your supply chain network.

Bottom line—collecting multi-tier data may be the most valuable thing your organization can do to reach its sustainability goals.

How to Approach Multi-Tier Assessments

Even though your first level of suppliers may be adhering to your code of conduct, the further down you get in your supply chain, the more often system pipelines break down, and ESG issues seep in through the cracks. Before they inundate your supply chain with risks, it pays to be proactive.

Yet, this alone comes with its own unique set of challenges:

- Tracking down who sub-suppliers actually are

- Building a tenuous foundation of trust

- Providing the tools these smaller suppliers need to understand and monitor ESG metrics

A solid approach is to first focus your efforts on the biggest risks in your sub-tier supply chain. Remember, you can’t tackle everything at once. Instead, focus on the suppliers that need your full support and attention. Perhaps these are the suppliers with the highest facility-level emissions intensity, or those who are not using any sustainably certified materials.

Not sure where to start? We’ve summarized some best practices and key things to consider for today’s most pressing supply chain sustainability issues. Browse through the graphics below!

Multi-Tier Hot Topics

Supplier Diversity

Tip: Tools like supplier.io and Tealbook provide databases of diverse suppliers for businesses to build new relationships with, but it’s equally important to build capacity with existing, non-diverse suppliers.

Scope 3 Emissions

Tip: Many suppliers don’t know how to calculate their emissions. On top of providing tools and resources to help them improve, ask for energy use data instead of emissions, which you can then use to calculate emissions intensity by spend.

Plastics

Tip: It may not be realistic to ask your suppliers to eliminate all plastics at once. Start by cutting back on single-use and virgin plastics.

Section 3 – Collaborating with your Suppliers to Improve

By this phase, you’ve aligned on your goals, collected supplier sustainability data, and uncovered your biggest risks. Now it’s time to take action, and that involves engaging with your suppliers.

Supplier engagement is urgently needed to create lasting impact, but unfortunately, doing it right is easier said than done. True engagement is more than simply sending out data requests to your suppliers.

Instead, it should be thought of as journey. Beforehand, organizations should prepare their suppliers for what is coming and ensure everyone is aware of what is needed. While collecting sustainability data from suppliers, organizations must provide support and issue reminders. Once assessments are complete, organizations should share results and co-create ideas for improvement, providing suppliers with the tools and resources to do so.

Supplier Engagement Varies

Supplier engagement is not a one-size-fits-all approach, so companies must adapt their engagement strategies depending on the supplier. Each supplier is at its own stage in sustainability, and companies must factor in a supplier’s size, region, product category, etc., before engaging.

Some engagement strategies will also need to be governed by the importance of the issue at hand and the priority level of the particular sustainability goal. If Scope 3 is an area of focus for your business, then suppliers that have the greatest emissions footprint would be a priority engagement.

Maximize Value to Scale Supplier Engagement

Keep in mind that your engagement and improvement efforts won’t go very far if you haven’t built a two-way street relationship with you suppliers. Not only do your suppliers need to trust the data collection process, but they should also be getting value from participating in your initiative. Your suppliers are likely dealing with hundreds of data requests per year, so if you’re constantly requesting data without providing anything in return, participation rates will inevitably falter.

Supplier value can come in a variety of forms. One great way to make the assessment process valuable for your suppliers is to share back the results, so they know where they stand in relation to their peers. Or, value can come in the form of offering preferential terms or more favorable contracting. An emerging practice is offering sustainable financing solutions to suppliers, giving them the ability to make the necessary infrastructure or equipment upgrades to meet your goals.

At the very minimum, your assessment initiative should reduce survey fatigue and be as standardized as possible. Supplier sustainability tech platforms can help scale this process, allowing information to be pre-populated and easily shared to multiple customers. For an overview of the market and its key players, check out the Gartner Market Guide for Supplier Sustainability Applications.

Section 4 – Collaborating for a More Sustainable Future

Another crucial ingredient for increasing the adoption of sustainable supply chains is industry-wide collaboration. In the context of responsible sourcing, multi-sector collaboration on a particular issue or category helps normalize a standardized approach for measuring and reporting on supplier sustainability performance.

Utilizing a standardized approach has a myriad of benefits for both you and your suppliers. For you, standardization saves time and resources, and often is associated with higher supplier response rates. For your suppliers, standardization significantly decreases burden. With so many different methodologies and frameworks out there, it can be challenging to get suppliers to engage in sustainability initiatives, especially if they’re small and strapped for resources.

That being said, a standard assessment may not give your company the information you need—customization has certain advantages that cannot be ignored.

Breakdown of Standard Assessments

Pros

- Encourages more widespread adoption of responsible sourcing practices

- Reduces burden on suppliers

- Easier to track performance over time

- Frees up time for value-added activities such as driving improvement with suppliers

Cons

- May not address your company’s specific needs

- May not provide granular enough information

Custom Assessment Breakdown

Pros

- Let’s you capture more meaningful data

- Ideal when there is no set industry standard

Cons

- Limits adoption of industry standardized approaches for measuring and reporting on sustainability performance

- Increases burden on suppliers

- Reduces industry collaboration

Our advice? Use a standardized approach wherever possible, and if you need more specific information, supplement with custom questions.

Industry Group Roundup

Businesses that want to accelerate their supply chain sustainability practices and promote standardization should collaborate with industry groups. Luckily, there are already well established groups in every business vertical and sustainability topic, from apparel to CPGs.

Take some time to familiarize yourself with the specific industry groups that will be able to help you standardize, access information, and provide resources to your suppliers. Some great examples include The Sustainability Consortium, which has created a platform for consumer goods retailers and suppliers to come together to increase product sustainability, and the Sustainable Apparel Coalition, which has developed a robust suite of tools to standardize supply chain sustainability in apparel, footwear, and textiles.

Putting the Pieces Together

To summarize, to build a sustainable supply chain, we recommend you focus on four main areas.

- Unify data and break down silos, understanding the critical role of procurement and setting company-wide sustainability goals.

- Utilize supplier assessments to identify your biggest risks and opportunities, making sure you know the difference between passive and active methods and when to employ each, and asking targeted questions of all tiers of suppliers.

- Turn your data into action by engaging your suppliers and creating a supplier sustainability improvement roadmap.

- Collaborate with companies in your industry, drive innovation in groups, and use shared resources to champion supply chain sustainability.

SupplyShift was acquired by Sphera in January 2024. This content originally appeared on the SupplyShift website and was slightly modified for sphera.com.