Applying GHG Protocol, PCAF and Science-Based Target Methods for the Financial Sector

To decarbonize the global economy in alignment with the goals established by the Paris Agreement, all economic actors in the real economy need to reduce their greenhouse gas (GHG) emissions sufficiently to align with required emissions pathways. Corporate emissions do not occur in a vacuum but within a broader economic and regulatory system consisting of incentives and disincentives for economic actors to reduce emissions. Having long focused on the risks climate change poses to the profitability and longevity of financial activities, financial institutions and private equity must now shift focus on their climate impact through their investment and lending activities, while leveraging their economic influence to facilitate decarbonization. Upcoming regulations, including the European Sustainability Reporting Standards under the Corporate Sustainability Reporting Directive (CSRD), the Sustainable Finance Disclosure Regulation (SFDR) and climate-related disclosure requirements from the U.S. Securities and Exchange Commission (SEC) are taking hold.

Linked financial bodies are also taking action. For example, the European Central Bank (ECB) plans to further incorporate climate change considerations into its monetary policy framework. This will include steps to gradually decarbonize its portfolio of corporate bond holdings and introduce climate-related disclosure requirements. The central bank plans to transition the Eurosystem’s nearly €350 billion corporate bond portfolio towards issuers that demonstrate more favorable climate performance. To do this, the ECB will examine greenhouse gas emissions, carbon reduction targets and climate-related disclosures.

Sphera advises financial market players on GHG accounting, as well as on the assessment, quantification and reduction of financed emissions. This article provides an overview of standards and methods for GHG accounting and climate target setting for financial institutions and private equity.

The measurement of indirect scope 3 emissions, especially financed emissions, is a complex part of quantifying the GHG emissions of financial institutions. Financed emissions are the GHG emissions emitted, avoided or removed by entities that receive financial services, loans or investments by the financial institutions. They need to be accounted for and included in an organization’s GHG inventory.

GHG Protocol

To understand how to quantify financed emissions, we have to look at the GHG Protocol Scope 3 Accounting Standard. Financed emissions must be accounted for under Category 15 Investments. This category is applicable to investors (i.e., companies that make an investment with the objective of making a profit) and companies that provide financial services.

Category 15 is designed primarily for private financial institutions (e.g., commercial banks) but is also relevant to public financial institutions (e.g., multilateral development banks, export credit agencies, etc.) and other entities with investments not included in the measurement of scope 1 and scope 2 GHG emissions.

Partnership for Carbon Accounting Financials (PCAF)

PCAF is built on the GHG Protocol and is in conformity with requirements set forth in the Scope 3 Accounting and Reporting Standard for scope 3 category 15 investments activities. It is the sector guidance on calculating financed emissions and provides advice on how to disclose GHG emissions through GHG accounting for six asset classes: listed equity and corporate bonds, business loans and unlisted equity, project finance, commercial real estate, mortgages and motor vehicle loans.

It differentiates between three types of financed emissions:

- Generated Emissions: The volume of GHG emissions emitted and financed by an institution

- Removed Emissions: Loans and investments that demonstrate a positive contribution toward decarbonization, e.g., investments in carbon sequestration activities

- Avoided Emissions: Loans and investments that result in emissions being avoided, e.g., investments in renewable energy projects

Emission Scope: PCAF requires that financial institutions report borrowers’ and investees’ absolute scope 1 and 2 emissions across all sectors, as well as scope 3 emissions for specific sectors. (From 2026, this will apply for all sectors.)

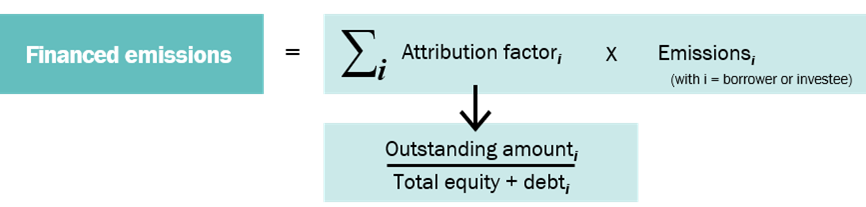

Equations to Calculate Financed Emissions: To calculate financed emissions in line with PCAF, an attribution factor representing the proportional share of a given company is needed.

PCAF Calculation Options: PCAF identifies the following options for calculating the financed emissions from listed equities and bonds:

- Reported Emissions: Directly collected from the borrower or investee company or via verified third-party data providers and then allocated to the reporting financial institutions using the attribution factor.

- Estimated Emissions: If emissions of the investee company are not available, these need to be calculated. PCAF requires financial institutions to prioritize primary physical activity data to be collected from the borrower / investee company (e.g., megawatt-hours of natural gas consumed or tons of steel produced). The emissions should then be calculated using an appropriate calculation method with verified emission factors per physical activity.

To aid financial institutions in quantifying their financed emissions, Sphera offers support through our GHG accounting methodology expertise and databases. Sphera runs the largest real-industry, third-party-verified and annually updated LCA database globally. This includes more than 17,000 datasets and over 100,000 inventories for any kind of industrial material, product or activity.

Financial Sector Science-Based Targets

Launched in February 2022, the Science Based Targets initiative (SBTi) introduced sector-specific guidance for science-based target setting for financial institutions. The guidance supports three methods for financial institutions:

- Sectoral Decarbonization Approach (SDA): The Sectoral Decarbonization Approach (SDA) is a method for setting physical intensity targets that uses convergence of emissions intensity for financed emissions in the power generation, cement, pulp and paper, transport, iron and steel, and buildings sectors.

- SBT Portfolio Coverage Approach: In the SBT Portfolio Coverage method, financial institutions commit to engaging with their borrowers and/or investees to set their own science-based targets.

- The Temperature Rating Approach: Under this approach, financial institutions determine the current temperature score of their portfolio based on the public GHG emissions reduction targets of their investees. It enables financial institutions to set targets to align their base-year portfolio temperature score to a long-term temperature goal.

Private Equity Science-Based Targets

Further, there is a specific Science-Based Targets method for private equity, based on the existing financial sector guidance. It supports PE firms’ general partners in setting ambitious greenhouse gas (GHG) emissions reduction targets (SBTs) for their operations (scope 1 and 2 emissions) and firm-level portfolio SBTs for their investment and lending activities (scope 3 category 15). It maps available portfolio target-setting methods from the SBTi financial sector method to the most relevant asset classes for the private equity sector, in line with the three approaches mentioned above.

Foundations for a Financial Institutions SBTi Net-Zero Target Standard

The SBTi is also currently developing a Net-Zero Standard for financial institutions, to be published in Q1 2023. The current draft proposes two conditions for financial institutions to reach a state of net zero emissions:

- Align all financing with pathways that limit warming to 1.5° Celsius with no or limited overshoot.

- Contribute to the net-zero economy by explicitly reallocating financing activities at a rate consistent with global climate goals and therefore neutralize residual emissions through financing of climate solutions that permanently remove an equivalent amount of atmospheric carbon dioxide.

The Benefit of Experienced Guidance

Even a brief review of the primary standards and targets conveys the challenges involved in target setting, measurement and reporting for climate-related disclosure requirements. Professional guidance and expertise will help. At Sphera, we offer the data, software solutions and consulting services that support compliance efforts and help drive lasting change. With Sphera’s GHG accounting and science-based target-setting support, financial institutions gain the guidance and tools they need to efficiently manage these reporting requirements.