The pandemic year has taught us that Sustainability is not just about tackling environmental risks but much more. It is about creating resilience into infrastructure, and this is where the Environmental, Social and Governance (ESG) conversation comes into play.

There is a heightened social, corporate, governmental, and consumer attention on the impact of corporations. The U.S. Securities and Exchange Commission (SEC) recently stated that corporate disclosures on Environmental, Social and Governance ESG issues will be a high priority for them. Investors are looking for a strong ESG proposition to protect their interests and the company’s success. The fine line between doing good and what is profitable is fast diminishing. According to the SEC, efforts to maximize the bottom line and the pursuit of the public interest are complementary.

What Is ESG?

E is for Environmental: The E is the ESG is perhaps one of the most important concerns of the 21st century – the environment. How companies use energy and manage their environmental impact have far-reaching consequences on society and the planet.

S is for Social: The social impact may not be evident right at the onset, but it is an integral part of the ESG framework. How a company fosters its people and culture will have ripple effects on the broader community. Their inclusivity and diversity will pave the way for a sustainable future.

G is for Governance: There are two parts to this criterion. One is staying ahead of violations, ensuring transparency and industry best practices, and dialogue with regulators. The other is the internal system of controls, practices, and procedures to govern and make effective decisions.

Why Is ESG Important?

According to the European Green Deal, by 2050, all member states will have circular economies, having achieved net-zero emissions. While the European Union (EU) has a head start, the United States also has bold plans to decarbonize the economy and aim for net-zero emissions target by 2050.

Companies are already experiencing the financial consequences of failing to act on sustainability as many countries have implemented regulations, such as carbon taxes, and the financial and banking sectors have integrated ESG rules into their funding criteria. The only way stakeholders can avoid poor lending conditions and exclusion from capital markets is to show evidence of having developed robust sustainability and ESG strategies.

In addition, the private equity market also includes sustainability and ESG criteria into its portfolio strategies. Private investors have realized that investing in companies with a robust and convincing ESG strategy positively affects ROI, reduces lending and revenue risks.

Investors are increasingly considering ESG issues to help manage investment risks. ESG performance ratings and reports show investors a company’s efforts to mitigate risks and generate sustainable long-term financial returns.

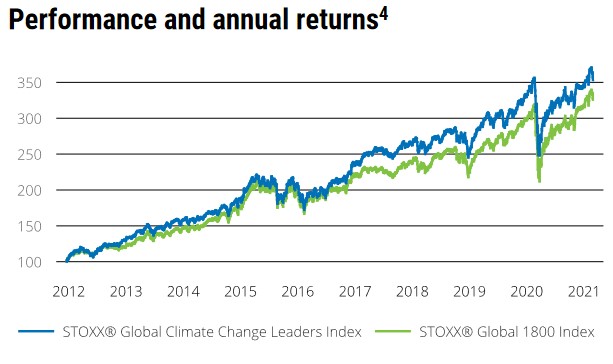

Furthermore, firms that have successfully implemented sustainability and ESG strategies tend to outperform the other top global companies:

Source: www.stoxx.com

ESG transparency is, therefore, a key focus for companies in 2021 and beyond.

Benefits of ESG

There are multifold benefits for companies to invest in development and implementation of robust ESG strategies. A strong ESG proposition can help create enormous business value across the enterprise.

- E: Sustainable practices attract more customers, allows better access to resources, lowers energy and water consumption and therefore also can reduce operational costs.

- S: Sustainable practices lead to greater social credibility, attract talent, boost employee morale, and build stronger community relations.

- G: Sustainable practices may lead to government support, subsidies, overcoming increasing regulatory pressure and better investor relations, e.g., in form of better loan conditions or lower capital costs.

What Does This Mean for Companies?

Companies need to put sustainability and ESG strategies in place right away, addressing the main challenges of net zero and circularity. Those who consider ESG aspects will have a higher valuation than those that do not.

The automobile and manufacturing industries will perhaps face the biggest challenges of all, especially with their supply chains. They need to invest in innovative product development to create new technologies that provide climate-neutral and circular solutions to the market. They need strong sustainability and ESG policies, which will make them more resilient during crises.

Finally, it will be upon the leadership to drive these ESG goals. Without proactive leadership, businesses cannot hope to make the industry-wide impact that we need. Forward-thinking C-level executives must focus on sustainability and make decisions for the greater good if they want to see solid bottom-line results from their strategic business decisions.

The good news is that businesses can develop sustainability and ESG strategies that achieve net-zero and circularity goals in compliance with 2050 targets remain profitable while maintaining access to financing through banks and capital markets. Sphera’s sustainability and ESG experts help companies develop net-zero and circularity roadmaps for their business that protect shareholder value, create opportunities for growth and innovation, and set the foundation for long-term success.