Blackstone Acquires Sphera For $1.4 Billion Signalling A Strategic Push Into ESG Digital Solutions

Blackstone Acquires Sphera For $1.4 Billion Signalling A Strategic Push Into ESG Digital Solutions

On July 6th, private equity giant Blackstone, a firm with $619 billion of assets under management, announced it had acquired Genstar Capital’s entire holding in Sphera valuing the business at $1.4 billion. This is the highest valuation for an EHS software vendor in the history of the market and also represents the highest value acquisition the market has seen. There has been a long evolution to arrive at a billion-dollar plus deal. Genstar originally bought a portfolio of EHS, product stewardship and industrial risk software assets from IHS Markit in June 2016. These software products had been developed from the late 1990s and brought together by IHS through a string of acquisitions.

In June 2016, the private equity owners appointed Paul Marushka as the CEO of the firm which they branded as Sphera. Under Marushka’s leadership Sphera embarked on an aggressive acquisition-led growth strategy. In June 2017 they added Rivo Software to enhance the cloud software proposition and establish a team in the UK. In January 2019 they bought Scotland-headquartered Petrotechnics to expand the TAM into operational risk management. In May 2019 Nashville-based Sitehawk was acquired to strengthen Sphera’s already commanding position in chemical management. In September 2019, Sphera bought thinkstep, a Germany-headquartered sustainability management and product LCA software and services provider. By the time of the sale of the business to Blackstone, Sphera counted more than 8,000 customers, 1 million users and 1,000 employees. The firm generates 40% of its revenues outside the core US market and has diversified the industry mix of its revenues such that oil and gas accounts for 20% of the total compared to approximately 50% in 2016.

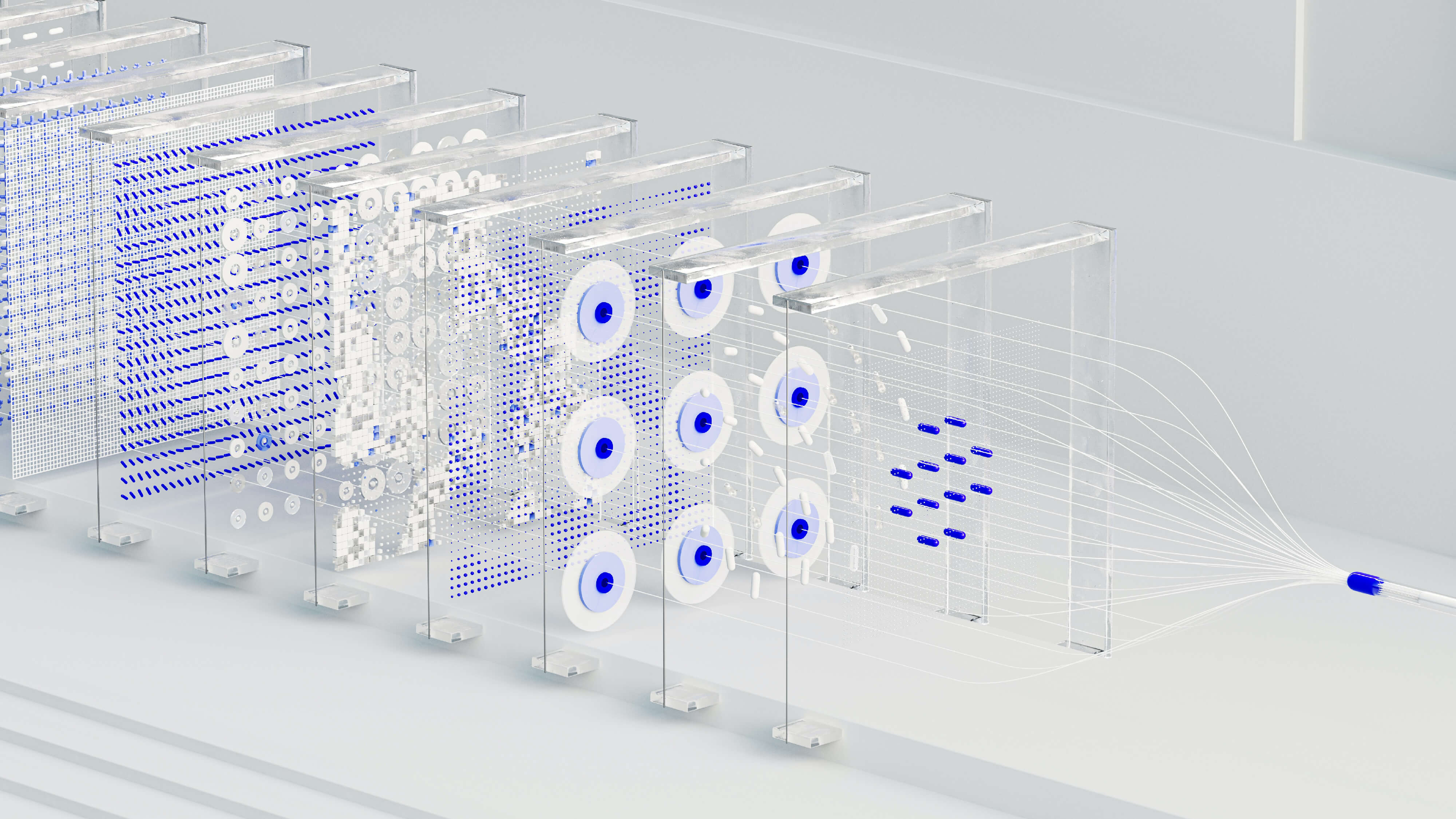

What can the market expect in terms of future developments? Firstly, Sphera’s CEO Paul Marushka has won the backing of Blackstone. He has demonstrated a knack for making acquisitions which expand TAM, add international presence, limit competitors’ strategic options and anticipate new growth opportunities. Expect more acquisitions which build on this strategy. Secondly, Sphera will be the jewel in the crown of Blackstone’s ESG capacity building. Not only does Sphera have a wide and deep bench of sustainability experts from its intelligent purchase of 250-employee thinkstep. It also has many of the software assets – air emissions, product compliance, worker safety, digital twins – to help industrials and manufacturers operationalize an ESG strategy. Blackstone can leverage these ESG digital solutions across its huge portfolio of assets. Thirdly, in 2020, Blackstone made a significant minority investment in contractor safety platform ISN which opens the door to deep integration with Sphera’s safety workflows. Fourthly, Sphera will need to implement a technology strategy based on micro services that goes beyond SpheraCloud to ensure acquired software assets can be quickly leveraged in a profitable way.