A Rise in ESG Funds

Earlier this year, a CNBC story announced that “There’s no hotter area on Wall Street than ESG with sustainability-focused funds ..….” An eye-catching statement that is also a testament to the rapid transformation toward a low-carbon economy and enhanced responsibilities to various stakeholders for value creation. Over the years, ESG has become a boardroom agenda and is deeply intertwined with the overall business and organizational strategy.

Verdantix CEO David Metcalfe recently stated that Environmental, Social and Governance (ESG) investing grew in 2020, and the corporate world must catch up with the new ESG goals in 2021 and beyond. Some ESG trends are highlighted below:

- Private equity firms are showing a surge of interest in ESGtech propositions.

- Financial services firms are launching a wide range of ESG products and services.

- Global consultancies are increasing their sustainability and climate change practices.

ESG and Sustainability – Similarities and Differences

ESG and sustainability are certainly the buzzwords of our time. Often used interchangeably and more often in the same sentence, both show the direction in which the world is progressing. Both address the environmental and social aspects, but there is a distinct difference between the two regarding disclosing and benchmarking data.

The dictionary definition of sustainability is preserving our natural resources to maintain an ecological balance.

In the business context, sustainability may mean different things to different entities. It is an umbrella term of “doing good,” which translates into ethical and responsible business practices. It incorporates terms like ‘green’ activity, corporate social responsibility (CSR), net zero and low carbon footprint, conservation of energy, water and resources, circularity, diversity and inclusion, human rights, health and safety, green supply chain, product stewardship etc. Another key term that falls under sustainable business practices is the triple bottom line that requires a company to include people and the planet along with the profit line on its balance sheet. Sustainability experts consider the stakeholders’ expectations and business significance while identifying the material topics across economic, environmental and social pillars. Embedded in most definitions of sustainability we also find concerns for social equity and economic development in addition to combating and mitigating environmental impacts.

ESG Meaning

ESG points to a specific set of criteria denoting environmental, social, and governance. It has become the preferred term for investors and the capital markets for responsible investment to incorporate ESG considerations in the business. The larger discussion in the industry began with sustainability, but it has evolved to include ESG performance and accountability. ESG data helps identify risk-adjusted returns, report and highlight relevance to capital opportunities. Emphasis on all three pillars has aided the shift in how companies measure and disclose their performance. ESG topics are interlinked and highlight the multifaceted risk to social, technological, political, environmental and economic aspects of the business. Companies are actively pursuing sustainability transformation to mitigate their ESG risks and prepare for the future as a leader.

The Three Pillars of ESG

E – Environment – Denotes how companies manage their environmental impact that has far-reaching consequences on society and the planet.

S – Social – Denotes how a company fosters its people and contributes to the inclusive growth Their inclusivity and diversity will pave the way for a sustainable future.

G – Governance – Denotes how companies can stay compliant, ensuring transparency and industry best practices, and dialogue with regulators. It also points to the internal system of controls, practices, and procedures to govern and make effective decisions.

Sustainable Practices & ESG: Intersections

Now that we know the differences between the two, let us look at where ESG and sustainability intersect and overlap. That will provide some clarity on why they are used interchangeably.

The European Union (EU) announced an ambitious plan for a sharply decarbonized future by pledging to reduce its emissions of greenhouse gases 55 percent by 2030 compared with 1990 levels. The United States has promised to reduce emissions by 40 to 43 percent over the same nine years.

Businesses play an intrinsic role in helping their respective countries achieve these ambitious targets and tackle climate change. They have a duty to care for the planet and its people, and they can only do so with sustainable and socially responsible practices. They are accountable for their actions and all stakeholders, from their customers to investors, employees, and the public – all have eyes on their environmental impact. The move towards sustainability includes transparent disclosures with financial implications for companies failing to report.

Corporate sustainability and climate change efforts are therefore fast transitioning from voluntary to mandatory. There is a clear direction for companies to develop robust sustainability and ESG strategies. Many countries have implemented regulations, such as carbon taxes, while the financial and banking sectors have integrated ESG rules into their funding criteria, as pointed out by Verdantix above. This has brought paradigm shift from historical “business as usual” to aggressive deployment of ESG risk management practices. ESG has become an increasingly important metric for capital markets. Companies with high ESG performance have proven to have lower risks, higher returns, and are more resilient in times of crisis.

Companies are more accountable for their actions than ever before. They have to reduce their CO2 output, or they may lose their license to operate. Recent news shows that fossil-fuel producers like Shell and Exxon face mounting pressure from investors, governments, and the courts to aggressively cut their emissions. They can only do so with clean and sustainable business practices. Insufficient sustainability policies will pull them back, and companies may find it hard to catch up with these changes unless they act now. As mentioned above, emphasizing all three pillars of ESG will help companies accurately measure and transparently disclose their performance.

Flipping the Coin: ESG, Sustainability and the Path Toward the Future

As we can see, the EU is focused on limiting global warming to pre-industrial times of 1.5C [2.7 degrees Fahrenheit]. Other leading nations are not too far behind.

There is a rising understanding that the economically optimal scenario globally is to stay below 1.5 degrees global warming. The current business-as-usual path leads to a 4.1 to 4.8-degree warming resulting in a 7-8% drop in global Gross domestic product (GDP) (Cambridge University, World Bank).

These numbers are motivating regulators and investors to take a closer look at their investments. Institutional investors, like BlackRock and Primco, want their investment companies to commit to net-zero targets.

As a result of these developments, there is growing awareness in global companies to act now and account for carbon emissions. They are setting their own net-zero emissions goals, defining clear decarbonization strategies with specific interim science-based reduction targets and deadlines, that can be quantified and announced publicly.

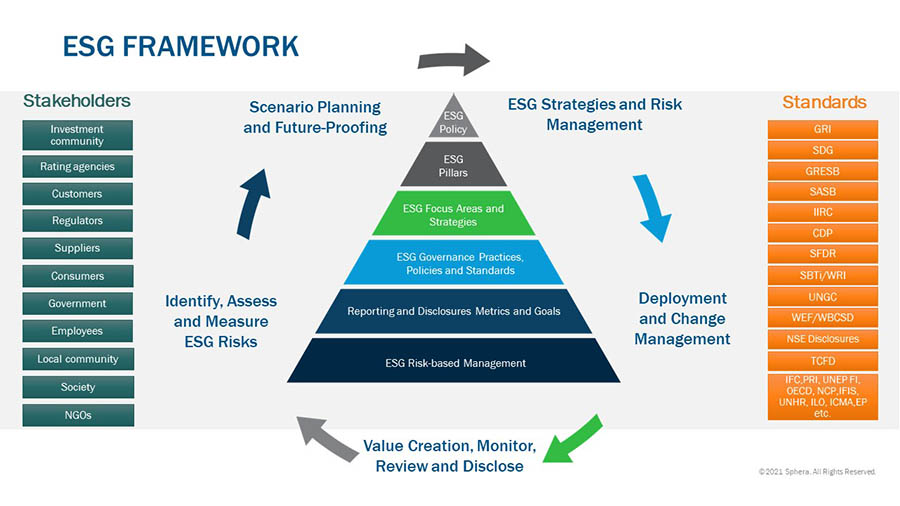

Disclosure is the essential first step toward environmental action and a sound financial future. There has been a proliferation of numerous reporting standards over the years, such as GRI, UNGC, CDP, IIRC, SDG, SASB, CDSB, TCFD, National level mandatory and voluntary reporting. There is also an emerging consensus on including non-financial metrics in mainstream reports such as an annual financial report, with the same discipline and rigor as financial reporting. WEF (World Economic Forum)- ESG reporting framework, known as Measuring stakeholder capitalism: Common Metrics and Consistent Reporting of Sustainable Value Creation, brings better alignment on ESG performance and contributions towards the SDGs.

ESG Trends

- Businesses are increasingly approaching ESG from a C-suite level.

- Organizations are facing and identifying climate-related risks and opportunities for their business as a top priority.

- A focused ESG strategy and implementation is therefore seen as a competitive advantage.

- ESG strategies lead to capital market access and increase business resilience.

- ESG reporting and disclosures catch investor attention and lead to strong ESG performance in the long term.

- ESG analysis and reporting can provide valuable insights and help create long-term value for stakeholders.

- ESG performance improvements and reports show investors how a company mitigates risks and generates sustainable long-term financial returns.

Proactive and future-focused companies with strong ESG performance demonstrate higher returns on their investments, while companies that do not provide these reports may risk potential investors overlooking them.

ESG transparency will be a key focus for companies in the future. A robust and intuitive software can help companies become 100% digitalized on ESG metrics. It offers a dynamic framework of data capture, treatment, validation, normalization and aggregation seamlessly addressing multiple reporting frameworks. This will help companies navigate the various regulations to reduce their emissions and financial risks associated with the same. Organizations are looking for technology platforms and software solutions to address present and evolving reporting requirements that are ready to scale and expand to cover additional complexities and cover evolving ESG requirements.

Setting a Foundation for ESG and the future?

The basic premise of ESG framework comprises two critically important drivers, viz. key stakeholders’ expectations and integration of various reporting frameworks. ESG Policy is an overarching top management intent providing the broad framework for responsibly driving business. ESG pillars are given equal importance, while ESG material topics are identified, prioritized, and defined as the highest importance to stakeholders and businesses. A robust governance structure combines controls, policies and guidelines that drive the organization toward its objectives, such as integrity, transparency, accountability, compliance to code of conduct, adherence to applicable regulations, etc.

ESG management will become an integral part of the overall business strategy. Organizations will leverage business opportunities, minimize risk, and seek to overcome social and business challenges through well- crafted ESG strategies. Organizations will also establish a company-wide strategy that cascades to businesses and functions with distinctly defined goals and targets. They will periodically monitor and review their ESG sustainability targets and disclose them to the respective stakeholders through various communication channels.

Greenwashing and promises for the future

Rapid changes in the economy, the pandemic and its unprecedented effects on our society, and the new era of digitalization have changed us as well. People have even less patience for greenwashing than ever before. Businesses can no longer operate with the promise of adopting “sustainable practices.” They must show definitive actions and results with accurate, on-time and committed ESG reporting. ESG and sustainability are the operational mantras for the future. Or, as the Mandalorian would say – “This is the way.”