Beginning of the End of the Fossil-Fuel Internal Combustion Engine?

What is currently happening in the auto industry is unprecedented. As a result of a wave of recent global regulatory changes, automotive manufacturers are now having to comply with new compulsion and emission regulations that have forced them into dramatically shifting their emphasis to new energy vehicles (NEVs), which includes battery electric vehicles (BEV), fuel cell electric vehicles (FCEV) and vehicles that utilize alternative fuels (bio-fuels or synthetic e-fuels) for internal combustion engines.

With this transformation, many automotive manufacturers are going beyond regulatory compliance to address the emissions in their supply chains. That means that Original Equipment Manufacturers (OEMs) are feeling intense pressure to adapt quickly or experience a mortifying drop in business as the demand for internal combustion engine (ICE) vehicles and parts starts to dwindle irreversibly. Of course, the elephant in the room is whether these recent developments are tantamount to the long-awaited—but not yet realized—beginning of the end for internal combustion as we know it.

1. Recent Emissions Regulations for Passenger & Light Duty Vehicles

2. Changes for Heavy Duty Vehicles

5. Hydrogen & Battery Electric Vehicles

6. Consumer & Corporate Incentives

8. Electric Powertrain Associations

10. Mobility Infrastructure Challenges

11. Panic About Carbon Footprints

1. Recent Emissions Regulations for Passenger & Light Duty Vehicles

On Sept. 19, 2020, California Gov. Gavin Newsom announced an executive order that, as of Jan. 1, 2035, all new vehicles sold in California need to be emissions-free. As the fifth largest economy in the world, when California implements a regulatory change with a deadline of 2035, it has a dramatic international impact. All vehicles sold in the state will have to be zero-emission vehicles, meaning battery-electric and hydrogen fuel-cell electric vehicles (or combustion vehicles that use bio-based or synthetic fuels) are the only options. This is good news for the environment, because we know that in California the largest volume of greenhouse gas emissions come from transportation. However, it will only make a positive difference for the environment if the energy used is sourced or produced from renewable resources in a sustainable manner.

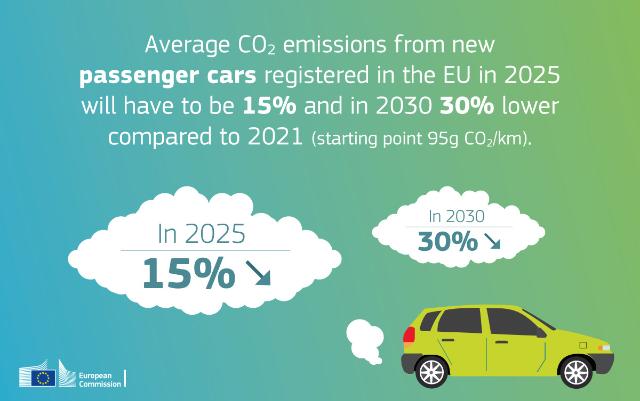

California is, of course, only one of many regions implementing legislative changes. The recent European Union CO2 regulations, which came into effect starting January 1, 2020, set new “CO2 emission performance standards for new passenger cars and for new light commercial vehicles” as well as heavy-duty vehicles, for which the CO2 regulation already became law in August of 2019. The United Kingdom announced the Road to Zero strategy and has planned to move the ban on fossil-fuel vehicles up from 2040 to 2030. France aims to offset its Paris emissions with clean hydrogen. Sweden, Denmark and Norway will phase out all non-zero-emissions vehicles by 2035. And the list goes on and on.

Within the EU, for passenger vehicles, the CO2 target levels calculated in grams per vehicle-kilometer have already been tightened. This has the potential to significantly impact OEMs’ annual profits, depending on how much an OEM would miss its targets and how many vehicles it sells, the potential fines could amount to hundreds of millions of Euros, or even billions of Euros, per year. “For every 1g/km of CO2 that a manufacturer exceeds its average emissions target by, it will be fined 95 euros (about $115) multiplied by its volume of new-car registrations in the preceding year,” wrote one journalist reporting on the potential penalties. Stated simply, we are talking about huge penalty costs for failure to comply.

The above infographic category also includes the rapidly growing SUV market in Europe.

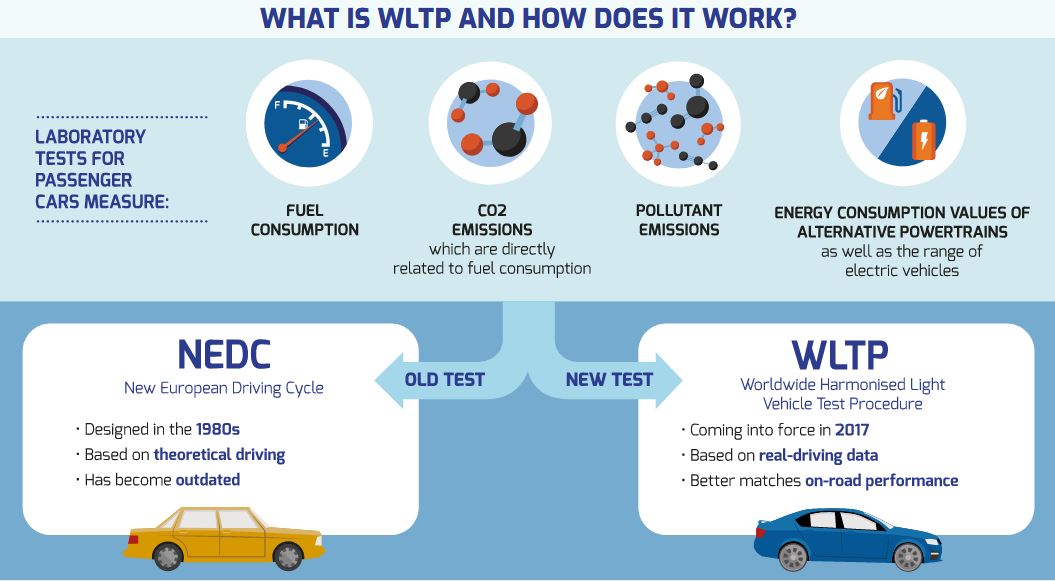

The China 6 standard for passenger and light-weight vehicles took effect July 1, 2020, effectively setting limits on air and climate pollutants, adjusting to the World Harmonized Light Vehicle Test Cycle (WLTC) and the World Harmonized Light Vehicle Test Procedures, commonly referred to as WLTP (see the infographic below), adopting the real-world driving emission (RDE) testing, along with several other tests and compliance-related measures for emissions. In September China committed to becoming carbon-neutral by 2060, which will also impact future emissions thresholds for their vehicle fleets.

The WLTP is a global pollution standard for all vehicle types that has been adopted by the Global Registry as well as China, Japan, the United States and the EU.

In Japan, the government passed new standards in June 2019 that require auto manufacturers to “reduce the consumption and thus the C02 emissions of their vehicles sold by 32% by 2030 compared to 2016 to an average of around 3.9 liters of gasoline per 100 kilometers.” This new rule effectively pushes Japanese automakers to make electric and hybrid vehicles a significantly larger percentage of their total vehicle production. Japan’s prime minister, Yoshihide Suga, who took office in September 2020, also recently committed to Japan becoming carbon-neutral by 2050. This will also affect future emission thresholds for their vehicle fleets.

In Canada, the government of British Columbia announced that the Zero-Emissions Vehicle (ZEV) Act, to be phased in starting 2025, will require that “all new vehicles sold in the province will have to be full-electric by 2040.” The ZEV Act, which includes a year-by-year framework, will effectively put a halt to provincial fossil-fuel-based vehicle sales within the next two decades. Since emissions from transportation make up roughly 40% of British Columbia’s emissions, the ZEV Act could have a huge positive impact on total emissions for the province.

2. Changes for Heavy Duty Vehicles

Accounting for about a quarter of CO2 emissions from road transport in the EU and for some 6% of total EU emissions, the CO2 emissions from semi-trucks (lorries), buses and coaches are still rising, mainly due to increasing road freight traffic. So, in order to contribute to achieving the EU’s commitment to fulfill the Paris Agreement, regulators have addressed the reduction of CO2 emissions from heavy-duty vehicles in Europe from two sides: demand and supply. The Clean Vehicles Directive addresses demand through the public procurement of eco-friendly vehicles. Regulation (EU) 2019/1242 is a supply-side regulation addressing vehicle OEMs that need to remain within CO2 emissions limits for vehicles sold and newly registered. Let’s look at each of these in greater details.

Demand side: Clean Vehicles Directive

While for the demand side, the European Union uses the instrument of green public procurement, it also established CO2 emission limits for all newly registered heavy-duty vehicles (HDVs).

As a first step, the directive on the promotion of clean and energy-efficient road transport vehicles was established in 2009 in the context of creating a green public procurement program—a voluntary instrument to stimulate green innovation. It was “designed to make it easier for public authorities to purchase goods, services and works with reduced environmental impacts.”

As a revision of the first Green Public Procurement Directive from 2009, the European Commission’s Clean Vehicles Directive from 2019, which will come into effect in August 2021, promotes clean mobility solutions in public procurement bids, aiming to provide a solid boost to the demand and further deployment of low- and zero-emission vehicles. Providing a definition of “clean vehicles,” it sets national targets for their public procurement. The directive applies to different types of public procurement, including purchasing, leasing, renting and relevant services contracts. It applies to cars, vans, trucks and buses (excluding coaches), when they are procured through regular public procurement processes.

Supply side: Regulation (EU) 2019/1242

Due to the still rising CO2 emissions from heavy-duty vehicles in Europe, the EU established the first-ever EU-wide CO2 emission standards for heavy-duty vehicles, adopted in 2019, which sets targets for reducing the average emissions from new semi-trucks for 2025 and 2030. These targets set a 15% CO2 reduction starting from 2025 onward and a 30% reduction from 2030 onward, using EU average emissions of newly registered heavy-duty vehicles, from July 1, 2019 to June 30, 2020, as the reference period.

The regulation explicitly aims to incentivize the uptake of zero and low-emission vehicles in a technology-neutral way and calculates the CO2 emissions in grams per tonne/km using a sophisticated calculation regime that provides individual emission factors per vehicle type and use category. If a vehicle manufacturer fails to achieve these set targets, it will face severe fines of €4,250 (about $5,150) per gram of CO2 per tonne/km, fines which have the potential to significantly impact the financial situation of noncompliant manufacturers. In 2022, the EU will review the 2030 targets.

On the national level, countries are also acting on heavy-duty vehicles. In the United States, the Environmental Protection Agency (EPA) is developing new standards on the Cleaner Trucks Initiative, which is currently focused on reducing NOx levels for heavy-duty vehicles, and has announced an advanced notice of proposal rule for all stakeholders to bring emissions for such vehicles under control.

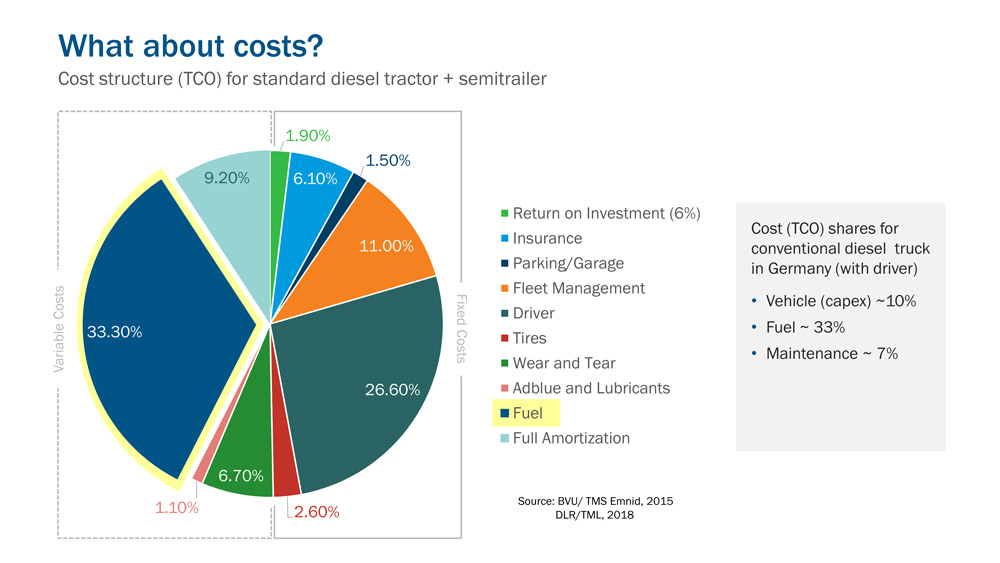

In another example, on October 6, 2020, Germany introduced a carbon tax that will start placing a price of €25 (about $30) per tonne of CO2 originating from fossil energy carriers, starting in 2021. With this tax, Germany has created a tool to set a price for CO2 in sectors which are not already part of the European Emission Trading System, meaning the transportation and buildings in particular. Everyone who sells fossil-based energy, regardless of the use, to end users in these sectors, must pay these taxes, costs that are inevitably passed on to consumers. Such measures will also affect the use of fossil-based fuels in heavy-duty vehicles.

Using the starting price of €25/tonne as an example, the price of one liter of diesel will increase by 7 cents. Gradually increasing from year to year, the carbon tax price corridor will reach a price corridor from €55 to €65 (about $66 to $79) per tonne of CO2 emissions on diesel by 2026, meaning 17 cents more per liter in the case of €65/tonne CO2. That means that diesel-based transportation within Germany will become more expensive. If companies do not respond to these taxes by turning to alternative fuels or electric vehicles, it will lead to an increase in road-based transportation costs of about 4% to 6% for heavy-duty vehicles. Not much, you might say, but enough to significantly cut into margins or raise prices for consumer and B2B goods.

This chart shows the costs of distribution for heavy-duty transport using a standard, diesel-powered tractor semitrailer unit. The imposed CO2 tax will lead to an increase of transportation costs between 4% and 6%.

3. The Energy Transformation

In order for this mobility transformation to be effective in drastically reducing global warming and other environmental impacts, an energy transformation needs to accompany it. Countries already using their regulatory power to bring the mobility sector in alignment with the Paris Agreement will still fall short of their goals—despite getting everyone to switch to producing and driving alternative-powered vehicles—if the source of the electricity used to manufacture and charge or refuel such vehicles comes from fossil-fuel-based sources. In other words, the environmental success of the upcoming transformation in the mobility sector will require a simultaneous and dramatic transformation of the energy sector.

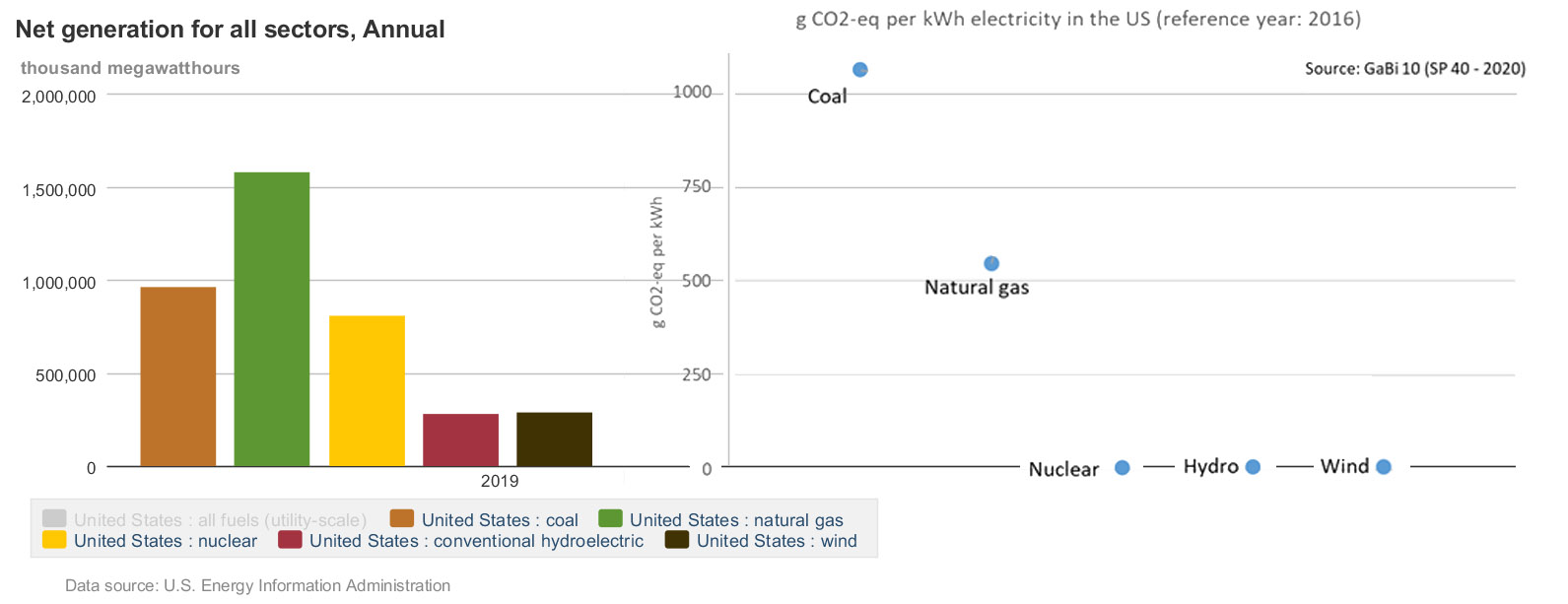

Let’s examine what this means, taking the United States as an example. According to the U.S. Energy Information Administration, in 2019, the United States generated electricity from the sources shown in the following chart:

Here we see how large the role of coal and natural gas play in the production of electricity within the United States. Those two sources need to come down dramatically within the next decade. Nuclear energy could be a viable alternative to renewables, if it weren’t so expensive and didn’t produce radioactive waste. Fast-neutron reactors may be the safest alternative, if businesses or governments can ever produce them affordably.

Of course, the mobility sector achieves its sustainability goals by putting electric vehicles on the road that are counted as “zero emissions.” The energy sector then needs to work on the carbon intensity of the grid as part of achieving their own emissions reduction goals. So, it is not the mobility sector’s explicit responsibility to make the grid less carbon-intensive. Nevertheless, thinking systemically, the transformation of the energy sector is necessary for mobility’s ability to enable users of their vehicles to use them in a carbon-free way.

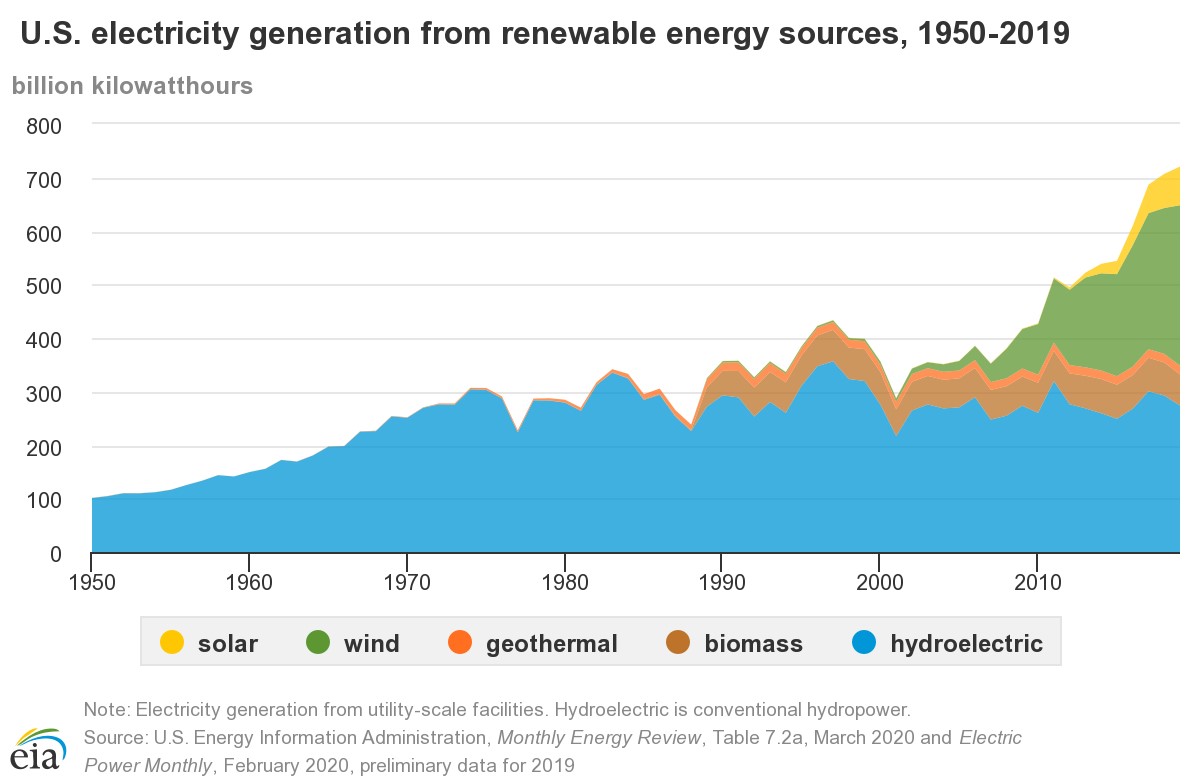

Renewable electricity generation has more than doubled since the year 2000 with wind power accounting for most of the gains. President-elect Joe Biden campaigned on the commitment to a carbon-free power sector by 2035, and this chart seems to imply that the United States is on the right track. However, the U.S. will have to increase wind and solar power at least 10 times more than it is currently to achieve the necessary energy transformation.

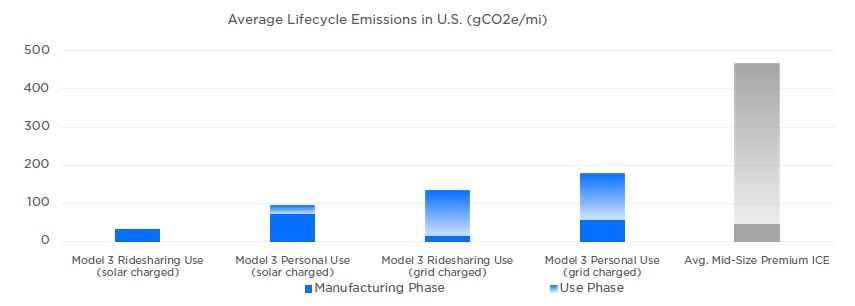

Having outlined the challenges for the energy sector in relationship to mobility, we should remember that the technology supporting sustainability in electric vehicles is moving at an extremely quick pace with a lot of investment behind development. So, for example, from the Tesla Impact Report we learn that:

- GHG emissions of battery production has been reduced significantly—the cradle-to-gate carbon footprint of the Model 3 Tesla is now only moderately higher than for a conventional internal combustion engine (ICE) vehicle.

- Even if we use the current U.S. energy grid mix, the life cycle carbon footprint of a Model 3 Tesla is already considerably better than an ICE vehicle’s carbon footprint.

This chart from the Tesla Impact Report (p. 8), reveals how much less of an environmental impact the Model 3 has than the impact of an average internal combustion engine vehicle, even when recharging through the current U.S. energy grid mix.

Using 200,000 miles as the lifetime mileage, that means that the most advanced electric vehicles are already significantly outperforming conventional internal combustion engine vehicles that rely on fossil fuels.

4. The Nonfossil-Fuel Debate

Theoretically, you can run a combustion engine on a synthetic, non-fossil-based fuel. A synthetic fuel is generated by taking hydrogen and CO2 (extracted from the air, biogas or other sources with high CO2 content) and using a catalyst to transform it into a synthetic fuel. This allows you to store the fuel so it can be transported by existing infrastructure.

Alternatively, you can produce biofuels made from bio-wastes, corn or some other plant-based source. These renewable fuels seem promising as long as they are produced and transported using sustainable energy and as long as land and water use is calculated into the sustainability equation and does not compete with agricultural food production. However, it’s often expensive and complicated to produce such fuels, and they “will require large-scale expansion of renewable energy” in order to be successful.

For sure, public opinion is rising against business as usual in the fossil-fuel industry. And governments, especially within Europe, are responding. Denmark, the fourth largest Oil & Gas producer in Europe, announced it is ending exploration. The shift in public opinion is particularly prominent with millennials, who, as the largest generation in human history, will continue to drive consumer behavior throughout this decade.

5. Hydrogen & Battery Electric Vehicles

Efficiency is a challenge with both hydrogen fuel cell and battery electric vehicles depending on how the vehicles are used. To be more specific, with hydrogen fuel production, the electricity demands are two to three times higher than for the charging of electric batteries. If you produce hydrogen for hydrogen electric vehicles, you also have two additional conversion steps. So, the electricity produced from, say, a wind turbine has to be converted into pressurized or liquid hydrogen. You then fill your hydrogen-electric vehicle with hydrogen, and the car converts that hydrogen back into electricity to power the vehicle. In other words, the electric energy is converted into a chemical energy, and then it is converted back into electric energy again.

Of course, batteries are also storing electricity in a chemical form. And yes, there are energy losses with battery electric vehicles during the charging and discharging of the battery (LFP, NMC, LCO, MCA, etc.), but the losses are much lower than with hydrogen conversion.

On the other hand, hydrogen offers storage advantages over batteries. If you compress the hydrogen, then the energy density is higher. Producing car batteries for EVs is energy-intensive. With hydrogen, you also don’t have to carry a heavy battery around, and producing traction batteries for cars can take a considerable amount of energy as well (although long-term, this will cease to be an issue as technology approaches closed-loop systems, as are already in place for lead-acid batteries). Plus, companies producing EV batteries are confronted with serious social, environmental and health impacts in collecting the required materials for batteries, such as the cobalt from the Congo, and the environmental and political corruption connected with lithium extraction in Chile (see Sphera’s blog about safety and cobalt in the Congo).

With hydrogen, you have these problems at a reduced scale since only small high-voltage batteries are needed. Additionally, the platinum demand per fuel cell vehicle has been dramatically reduced to a level almost comparable to the amount used in today’s ICE-based vehicle exhaust systems. Plus, hydrogen fuel cells give users a longer driving range with significantly shorter refueling times. Because of the weight (and volume) of batteries, hydrogen fuel cells make more sense than batteries for larger commercial vehicles. That’s why many companies that manufacture semi-trailer trucks are focusing more on hydrogen-electric solutions. For smaller vehicles with shorter ranges of around 200 to 300 kilometers (125 to 185 miles), a battery electric drivetrain may make more sense.

Another issue to consider is that battery-electric vehicle sales are currently far greater than sales of hydrogen-electric vehicles. As a result, at least for passenger vehicles, battery electric vehicles may become the vehicle of choice, something akin to what happened when consumers chose VHS machines over the Betamax alternative for their VCRs. At a certain point, the market may tip in a single direction, although it may take several decades. The costs and limited infrastructure of hydrogen may simply push it out of the market, at least for short-range passenger vehicles. But we may also see both rise together—it is too difficult to predict at this point, as both technologies are receiving massive investment.

While we are restricting this blog to developments in battery-electric, hydrogen-electric and alternative-fueled vehicles, there are all kinds of other innovative types of transportation in the works, such as Virgin’s Hyperloop and the Siemens eHighway, which is developing certain sections of the German autobahn for electrified freight transport. So, ultimately, the future is hard to predict, but a radical mobility transformation is underway.

6. Consumer & Corporate Incentives

Countries, regions and cities around the world are also offering tax credits and other incentives to encourage this transition. In the United States, the federal government offers up to $7,500 in tax credits through the Qualified Plug-In Electric Vehicle (PEV) Tax Credit for each vehicle that you purchase that “draws propulsion using a traction battery that has at least five kilowatt-hours (kWh) of capacity, uses an external source of energy to recharge the battery, has a gross vehicle weight rating of up to 14,000 pounds, and meets specified emission standards.”

In Germany, there are incentives for both charger and vehicle purchases, including grants of up to €9,000 (about $10,900) for the purchase of a fully electric passenger vehicle as well as tax reductions. Germany also plans to have 1 million charging stations throughout the country by 2030. In 2020, for heavy-duty vehicles, you can receive €40,000 (about $48,000) in funding when you procure a small to medium-size electric truck (class N2; < 12 tonnes) and up to €500,000 (about $607,000) for a heavy-duty electric truck (class N3; > 12 tonnes) from the Federal Transport Ministry. The German government is also preparing a program starting in 2021 that aims to cover up to 80% of the additional cost of purchasing heavy-duty vehicles that use electric drivetrains.

China has extended its new energy vehicle (NEV) subsidies until 2022 for “passenger cars costing less than 300,000 yuan ($42,376).” Japan, too, has subsidies for commercial and individual purchases of vehicles. We could review the incentives of many countries, but you get the point—businesses and individual consumers have access to incentives that make switching to electric vehicles more appealing.

7. Supply Chain Challenges

Most automotive manufacturers have set ambitious sustainability targets, for example, Volkswagon’s 2050 target and Daimler’s 2039 target. Because of higher carbon emissions in the manufacturing of electric vehicles, car manufacturers are focusing on their supply chains and especially on hotspot materials, such as aluminum and steel or battery and electric components. This means they now focus on their supply chains to reduce their overall emissions. Electric vehicles that run on renewables have also contributed to this new focus, because they have a zero-emission use phase. This is a game-changer, because it moves the topic into purchasing departments of OEMs, which traditionally only made decisions based on price and technical performance (ability to design). Now CO2 is an integral part of purchasing decisions, including the choice of the right supplier. OEMs unable to compete in the sustainability of their components will pay the price. The new regulations and the new corporate and fleet goals affect the pricing of components, because the higher the emissions during the manufacturing phase of these parts, the higher the various pricing mechanisms attached to such emissions will be for those parts. Major auto manufacturers simply won’t buy the parts from suppliers with weak sustainability performance.

As you might know, combustion engines have far more parts than electric engines. As infinion indicates in an overview of electromobility, “ combustion engine has around 2,500 components that have to be made and assembled—compared with just 250 in an electric motor.” Of course, EVs pose sustainability obstacles in their material components, such as metal extraction, processing and recycling. So, what does this mean if you want to make your supply chain for electric vehicles more sustainable?

In our experience, OEMs tend to focus on steel and aluminum production routes for becoming more sustainable, considering alternative technologies, secondary materials and closed-looping as well as alternative energy inputs, such as hydrogen. They seek close collaboration with their main suppliers, not only to collect primary production information to quantify the manufacturing process of the specific supplier, but to calculate the reduction possibilities. In addition, high-voltage batteries play a critical role. You can’t build such batteries without nickel, rare earth elements and copper. You’ll need lithium and likely cobalt for battery electric vehicles and platinum for fuel cell electric vehicles. We identified six materials as critical in our e-mobil BW study. (Note: this report is written in German.)

Complex but Essential

The supply of raw materials for EVs is a highly complex topic. However, ignoring it won’t make it less complicated. On the contrary, if we don’t deal with the supply of raw materials now, it will backfire on us within this decade. So manufacturers need to examine the supply chain of raw materials necessary for building EVs. As a next step, OEMs need to work with their suppliers throughout the development process. This can involve the EV-producing company as well as the suppliers along the supply chain. It’s easier to start with one supplier and expand your knowledge of the process step by step.

The Six Key Elements

Our study found cobalt, copper, lithium, nickel, platinum and rare earth elements are the most critical. First of all, that means that there is a high supply risk for these materials. It depends on the static range and the regional concentration of the raw material production and deposits available across the planet. The higher the static range and the more countries produce and hold deposits of the material, the more the risk is reduced. In addition, examining the national political and regulatory risk completes the supply risk analysis. In a second step, it’s important to understand the technical and economic consequences that would occur if the supply risk turns into an actual supply shortage. Here, we need to know if there are substitutes and, if there are, how much more would it cost to build EVs with those substitutes? Two examples: You can’t build a lithium-ion battery without lithium, and you can’t build a fuel cell without platinum—there are currently no alternatives.

Socio-ecological Standards

When companies investigate raw material supplies, cost is, not surprisingly, the most important factor. However, if you want to holistically investigate the sustainability of your business and the consequences for your brand and reputation, you need to take social and ecological aspects of raw material sourcing into consideration. They include:

- Working conditions in the mines

- Civil rights

- Political framework within the country

- Social contributions by the local mining companies

- Environmental aspects

Admittedly, there are efforts to improve conditions in these five categories. The industry as a whole—and some companies in particular—have increased their awareness and made decisions that bring about change. But is this going to be enough? Unlikely, because companies can always do more to help secure the well-being of people and the environment. Ultimately, we need to look toward the long-term future health of our planet and, thereby, our own future health.

What’s Next?

For OEMs, we recommend the following steps to create a raw material supply chain strategy for EV production:

- Analyze the materials used in your product portfolio.

- Quantify the risks for your business.

- Prioritize the scope of action to take.

- Cooperate with material suppliers all the way up to the material source (i.e., the mine or the recycling facility).

- Increase your company’s sustainability knowledge and help create public awareness.

- Mitigate risk, for example, by reducing raw material dependency.

- Work with others to overcome the challenge of creating a sustainable transformation in the transportation sector.

As you can see, there’s a lot to do in the supply chain if companies want to improve the sustainability of their vehicles.

8. Electric Powertrain Associations

An electric powertrain consists of the electric source of power (e.g., a battery) and the mechanism (made of parts) that propels the vehicle forward. The Electric Drive Transportation Association (EDTA), the European Association for Electromobility (AVERE) and the Electric Vehicle Association of Asia Pacific (EVAAP) are three regional associations engaged in supporting their members and advocating for advantageous conditions to develop such electric powertrains. There is also the World Electric Vehicle Association (WEVA), a not-for-profit organization that “promotes research, development and deployment of electric drive vehicles.” Combined, these associations effectively constitute political advocates and organizational support mechanisms that push their members’ collective, alternative powertrain agendas.

There are many other organizations, such as NeMo, that are working to connect infrastructure, services and businesses, EV users and other stakeholders to facilitate the future of carbon-free mobility. These organizations are playing, and will continue to play, a critical role in the overall shift we are seeing for new energy vehicles. Mobility-related businesses will want to keep them on their radar to forecast future regulatory and industry changes.

9. Autonomous Vehicles (Av)

Currently, there is a great deal of investment in self-driving vehicles. According to one report, “It’s estimated that worldwide, at least USD$16 billion has been invested in work on AVs thus far.” The transition to autonomous vehicles is set to disrupt mobility (and society) in a big way in the coming decades. What that will mean for environmental sustainability is not yet clear. But we can begin to predict that it will have impacts in three areas: behavioral change leading to increased or decreased emissions, improved productivity for people and businesses and a reduction in accidents and therefore less injuries and loss of life.

An example of an autonomous vehicle is the Cruise Origin, a spacious van released this year that is the outcome of a partnership between Honda and General Motors Corp. Not intended for individual ownership, the Origin is designed as part of a subscription mobility model, which is owned by the manufacturers. With this model, people would no longer own their cars. Here again, if such a model takes off in the market, the resulting change may either increase or decrease the quantity of transportation that people engage in, depending on the subscription model people buy into. So, if you have unlimited transportation within your subscription, you may end up taking more unnecessary trips, because it is easy and convenient to do so.

For business, the picture looks different. Let’s take the massive semitrailer truck driver shortage in the major European economies as an example. Autonomous driving can help solve this shortage problem in specific markets, but in the long run, AV technology is likely to put a lot of semi drivers out of work in Europe and throughout the world.

In a new, automated vehicle world, AVs will also become competition for public transportation or will take over public transportation on urban streets (probably not subways or elevated trains) and for other short-distance transportation (taxies, Uber). Companies investing heavily in AVs talk about a three- to 10-year time frame for the transition. There is a lot of debate about legal frameworks, but the technology now exists. Yet, there are a lot of problems still to be ironed out. For example, who will pay for the necessary infrastructure development? We suspect it will depend on the country. German Chancellor Angela Merkel announced she wants Germany to be the first EU country to have its automated vehicle networks and infrastructure in place in five years. With all this technology in place or in development, it seems we will be confronted with ongoing infrastructure-related challenges, regardless of where we live.

10. Mobility Infrastructure Challenges

Let’s take a closer look at the serious infrastructure challenges that new energy vehicles need to overcome. They include:

- A lack of charging and refueling stations, especially for remote or nonurban areas. Although hydrogen electric vehicle fueling stations are available in various countries, the strongest infrastructure investment has happened in South Korea, Japan, China, California and the Northeast United States and central and northern Europe. All governments need to plan for and implement infrastructure improvements quickly to make the transition more seamless.

- Lack of electricity infrastructure so that people can charge their vehicles at home or so that commercial vehicles (such as bus fleets and commercial vehicle fleets) can recharge their batteries or refuel. Battery electric tractor vehicles, seeking a range of between 300 and 400 kilometers (roughly 185 to 250 miles), will need 600 kilowatt hours of installed battery capacity. In order to recharge these batteries, you either need to have a lot of time before you return to the road (e.g., a 100 kilowatt charger requires five hours to recharge a 500 kilowatt hour battery) or you need to increase your charging capacity, such as with a 350 kilowatt charger equipped with a water-cooled charging cable, which would require only 90 minutes to recharge.

- Lack of access to green energy for recharging batteries. This doesn’t prevent e-mobility, but it does increase the environmental footprint during the use phase of vehicles, partially defeating the purpose of owning and using an electric vehicle.

- The large cost to governments is in making infrastructure changes. This amounts to a legislative or political challenge in the context of various national and regional agendas and interests. It is estimated that utilities “will need to invest between $1,700 and $5,800 in grid upgrades per electric vehicle (EV) through 2030.” The costs will also depend on the optimization of consumers’ charging behavior.

- Low battery capacity and the total lifespan of batteries will pose additional charging challenges in terms of the speed of charging and will continue to remain an engineering challenge in regard to the weight of vehicles vs. the need for payload.

The infrastructure for passenger vehicles normally requires 150 kilowatts. Tesla vehicles, for instance, require around 125 kilowatts, but even with that, it still takes 30 to 40 minutes to recharge a battery. For passenger vehicles, that means the challenge is more about how to improve overnight charging in residential areas. In China, there are systems in place or being developed to swap out batteries under a vehicle within minutes. But such systems require the manufacturing of additional batteries, which itself has an additional environmental impact.

For passenger vehicles such quick swapping of batteries might be a possibility, but for bus or heavy-duty vehicle fleets it could become quite expensive. For these larger vehicles, the solution probably lies in the relocation of depots or the construction of geographically strategic charging and fueling stations. Whatever the solution for heavy-duty fleets, you need a quicker turnaround time, so you need significant improvements and investment in comprehensive infrastructure.

11. Panic About Carbon Footprints

Large automotive suppliers throughout the world are beginning to panic about their carbon footprints. They may find they can’t get the corporate or product (component) data they need. Right now, they’ve also got extremely tight deadlines. Once the pandemic comes to an end, perhaps as early as the summer or fall of 2021, the topic of CO2 will be the highest business and strategic point of relevance in the auto industry moving forward. “In the long run, climate change will be the biggest challenge mankind is facing,” said Volkswagen CEO, Herbert Diess, pointing to the post-COVID future. The stress surrounding the environmental situation is real and ongoing for many sustainability managers and those working in sustainability within large mobility companies.

Businesses can alleviate this stress by securing consulting guidance to integrate their emissions assessment processes, including their value chain, by assembling relevant and accurate data for calculations and by acquiring the kinds of software tools that enable independence in their sustainability efforts for the future.

The Future Of Mobility

In passenger and heavy-duty automobiles, the tide has turned globally toward new energy vehicles. For passenger vehicles, the shift will be predominantly to battery electric vehicles against the background of existing legislation, but hydrogen fuel cell and alternative fuels will continue to play a strong role. In commercial-sized vehicles, hydrogen-electric fuel cell and carbon-free combustion fuels are probably going to dominate.

We also see that there are going to be sharp reductions in the manufacturing of diesel and unleaded vehicles toward the end of this decade with CO2 pricing for such vehicles increasing significantly by 2030. Since new, alternative vehicles are often more expensive, this will pose challenges. But once the critical mass of demand allows manufacturers to produce at improved economies of scale, companies will start offering cost-competitive new energy vehicles. Regulatory bodies are likely to make up the difference and push people into the more-sustainable alternatives by offering both incentives and penalties. Over the long term, diesel-based trucking competition will be eliminated. Yet, ensuring the shift toward a broad uptake of these new technologies will continue to be a key international policy challenge.

Since companies are currently pouring so much capital and other resources into the development of new energy vehicles, we can expect that at some point their marketing engines will take over with massive marketing campaigns that decisively sway demand away from fossil-fuel-based vehicles and toward new energy vehicles. For businesses and individual consumers, this means more sustainable choices, which will reduce the negative impact of their transportation activities.

It is very likely that new energy vehicle transportation will continue to be more expensive in the short term, yet this added expense will be more representative of the true costs such transportation has on the environment. The additional expense could also lead to changes in logistics that restrict the unnecessary transportation of products, forcing companies to process or assemble in more localized regions, a trend we are already seeing as the result of COVID-19.

For the environment, all of this is good news. We are likely to see the desired reduction of carbon emissions in the transportation sector within the EU and other global regions, hopefully coupled with a dramatic shift toward renewable energy sources in the use phase of such vehicles. Fossil-fuel-based vehicles are on their way out. How long that process will take is hard to predict. However, the ever-worsening environmental impacts (heatwaves, forest fires, flooding, massive storms, extinction of species, etc.) will continue to place pressure on manufacturers, OEMs and their value chains to do everything in their power to drastically reduce their emissions, both upstream and downstream. Within this decade, the major automotive manufacturers will have switched focus beyond concentrating on the sustainability in the use phase of their vehicles into the impact of production, their supply chains and end of life.

In Europe, by 2035, the entire technology of vehicles will have shifted. Yes, there will still be diesel-based vehicles, but they will be seen with increasing skepticism by both individual and business consumers. New energy vehicles will be the norm and will eventually dominate the market.

The waves of change are already reverberating globally. It looks as if the expected shift from traditional combustion-based vehicles to new energy vehicles is finally underway. In fact, we feel confident in making the claim that these changes mark the beginning of the end of the fossil-fuel-based engine for both passenger and commercial roadway transportation.

Dr. Christoph Koffler, Sphera’s technical director for the Americas for Sustainability Consulting, and Niles Maxwell, Sphera’s content marketing manager, contributed to this blog.